Pay & Get Paid: How NFC & QR codes changed the way we do things.

Issue #34: Hello there, Welcome back. If you are new, welcome to you too! Each Monday Morning (somewhat) I share a newsletter about tech-enabled startups in South Africa, or how certain technology trends might be relevant for South Africa & sometimes the founding story of innovative companies. This week I want to tackle NFC & QR codes, the history, the payments application & one interesting company in South Africa.

Evolution of NFC

Near Field Communication is not necessarily a new technology, but the application is. As history goes, in 1973 inventor Mario Cardullo was first credited with a patent for read-write RFID (Radio-frequency Identification) & Charles Watson, an American entrepreneur was granted a patent for a passive transmitter & credited for the abbreviation1. But, RFID traces back to World War 2 when radar was widely used in air combat between the Allied Forces & Axis Powers. As radar & radio frequency advanced through the latter decades of the 20th century there was a need amongst entrepreneurs & the US Government to extend its use cases.

Mario’s patent & requisite investor pitch identified various use cases for passive transmission via radio frequency that could be deployed in the transportation industry for a myriad of use cases; vehicle identification, electronic license plates, automated toll systems, vehicle performance etc, plus banking use cases like electronic cheque book & electronic credit cards. Charles Watson, who in essence is the father of RFID for a patent for a passive transmitter added another patent for a key card & key card reader that is now used for controlled access to buildings & rooms. The US government too had a project at the Los Alamos National Laboratory. A group of scientists worked on an idea to put a transponder & a reader at gates for easy access. The group of scientists created spinoffs, which subsequently expanded the use of these transponders (aka tags) to automated toll gates across America2. Then in the late 1990s, the Agricultural Department requested RFID tags to be created as a way to track livestock that was getting ill. Los Alamos’s RFID system included the use of Ultra-High-Frequency (UFH) radio waves. With the increasing adaption of UFH RFID tags, more companies adopted the technology for asset tracking via embedded chips.

But taking a step back to simply the above & to provide future context on Near Field Communication (NFC), what is RFID?

“RFID is an acronym for radio-frequency identification & refers to a technology whereby digital data encoded in RFID tags or smart labels are captured by a reader via radio waves. RFID is similar to barcoding in that data from a tag or label are captured by a device that stores the data in a database.” abr.com

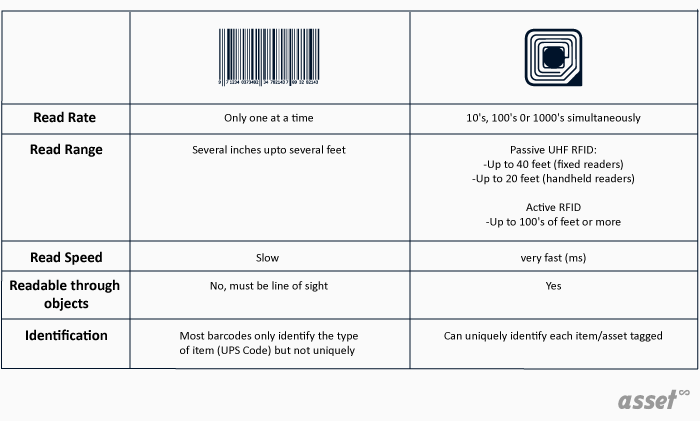

What makes RFID different from Barcode scanning? The main difference between RFID & barcode scanning is that RFID does not require a line of sight i.e beaming to a single item to record a reception. RFID has multi-scanning to track assets.

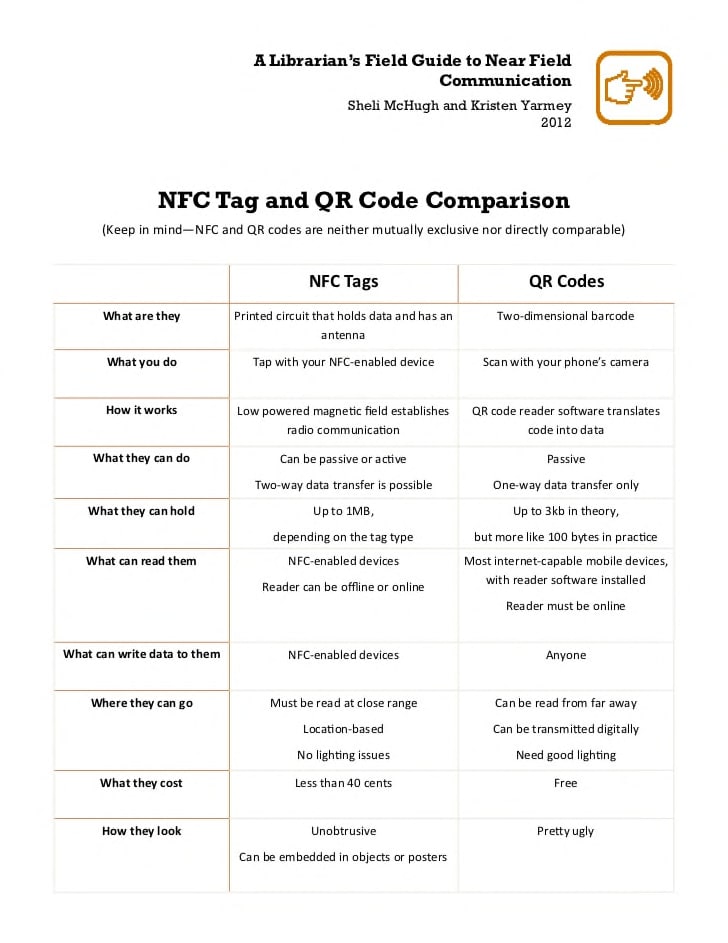

So, getting to Near-Field Communication (NFC) technology. It took me a long time to explain RFID & I don’t think I did it much justice. I am going to try to get to the point. What is NFC? NFC is a subset of RFID but with a shorter communication range for security reasons. There are some other differences related to read & write but at the base, that is the major difference.

Like I said at the beginning, NFC is not a new technology but its application is. It was co-invented in 2002 by Sony & Philips as a sub-set of RFID. In 2003 the International Organization for Standardization (ISO) approved NFC as a standard. ISO acts as a nongovernmental body that certifies the global standard & quality of applicable technologies across 160 countries. In 2004, Sony, Philips then joined by Nokia, officially launched nfc-forum.org as a non-profit.

But what did Sony & Philips invent? well, again nothing in particular – though an important use case. Because of Moore’s law, chips were getting cheaper & smaller & the idea Sony, Phillips & Nokia had, was to embed RFID chips inside mobile devices instead of people carrying around clunky devices, the mobile phone itself becomes a reader & thus expands the use the case. In other words, the mobile phone becomes the access device for many things. In 2006 the Nokia 6131 became the first device with embedded NFC technology. I know I’m regurgitating 'use case’ – the phrase. I think the better word would be ‘application’. Getting back to the Nokia 6131 was the first mobile phone with NFC technology, what was the intended application when Nokia released this device? the 2007 CNET press release specified that:

“NFC will allow users to instantly store & access business cards in their phone, gain access to an event, share information, & make quick purchases for items ranging from coffee to show tickets. Nokia promises that by touching their phone to an NFC-enabled business card, advertising display, or menu board, people can use their phone almost as an ID, a wallet, & a computer.”

This was in January 2007, 6-months before the first iPhone was released & almost 3 years before the first Samsung NFC device came to market.

But again, what is NFC? – simply put it’s a chip that allows devices to send information between them. The reason Nokia’s NFC device did not gain adoption was because of low supply side uptake. The NFC-enabled menu & business card had little adoption from the merchant side. There was no incentive for merchants to accept NFC-enabled devices.

This turned into 2013 when Samsung & Visa developed payment rails for NFC. Tap-to-pay to this day is the best application for NFC. Apple added NFC in 2015 & launched Apple pay for the iPhone 6. Visa & Mastercard went further to embed NFC chips on debit & credit cards.

But again, again – how does NFC work? NFC allows two devices that are 4cm from each other to exchange data. NFC introduces a new component to RFID, in conjunction with reading & writing data; the ability to execute other data. This is the nature of peer-to-peer sharing but in this context executing a command to transfer money within a 4cm distance using a debit/credit card &/or mobile phone from the initial command of reading & writing. Known to us as tap-to-pay.

Evolution of QR codes

RFID & NFC was a bit of a mouthful, I will try to keep QR codes a bit shorter. So since we know how NFC came about, it’s one form of mobile payments that we are used to, the other one is QR codes, perhaps used more than NFC by consumers. Like NFC, QR codes are fairly new. They have been around for about 29 years. The QR code technology was invented by Masahiro Hara while working for a division of Japanese automotive parts maker Denso – Denso Wave. Denso Wave at the time was developing barcode readers. The idea behind QR codes was to make the barcode hold more information3.

On making the QR code Mashiro stated the reason for the pattern after drawing inspiration from the Kanji & Kana characters (Japanese writing system). For the square the reason was simple:

“it was the pattern least likely to appear on various business forms & the like.”

For the characters:

“They came up with the least used ratio of black & white areas on printed matter. This ratio was 1:1:3:1:1. This was how the widths of the black & white areas in the position detection patterns were decided upon. In this way, a contrivance was created through which the orientation of their code could be determined regardless of the angle of scanning, which could be any angle out of 360°, by searching for this unique ratio.”

The QR code consists of 7 distinctive information types:

Version Information - indicates the size (number of modules) of a QR code

Format Information - encodes which error correction level & which mask pattern is in use in the current QR code.

Data & Error Correction - Reed–Solomon error codes detect & correct multiple symbol errors

Position - used for orientation, allows users to determine their current position on the map.

Alignment - corrects the crookedness or distortion of QR code.

Timing - enables the decoder software to determine the width of a single module.

Quiet Zone - blank margin of a QR code that's used to tell the scanner where a symbol starts & stops

In the 1990s, The QR code was mainly used to track assembly parts in the automotive industry. It gained its first ISO accreditation in 2000 for Automatic identification & data capture techniques i.e a de facto substitute for the barcode. Through the early 2000s, the QR code gained wider adoption as a marketing tool for access to the internet (URL) & price comparisons. Again, the QR code, like NFC, was searching for wider adoption amongst consumers. It found it in the payments & coupon industry in 2011. Alipay is credited for the application in payments, China is likely the first country to adopt it as a mainstream payment mechanism. Tencent’s WeChat followed with WeChat pay – the rest is history.

The Difference between NFC & QR payment

Like the RFID & the barcode, NFC payment differs from QR payment. Mentally you can differentiate them with phrases; “Tap-to-pay vs Scan-to-pay”.

“Each has its advantages & disadvantages. NFC offers faster, easier, more secure transactions & options, yet QR codes currently reach a wider market since more phones can read them than those that can read NFC tags” - nearfieldcommunication.org

One can argue bias there, but each fights against the security threat of eavesdropping.

Read/Write/Execute

NFC & QR codes are an evolution from their predecessors. They introduce a new component to read/write, which is – execute. The Unix/Linux file permission explains read/write/execute within file access modules as:

“File Access Modes

The permissions of a file are the first line of defense in the security of a Unix system. The basic building blocks of Unix permissions are the read, write, & execute permissions, which have been described below −

Read

Grants the capability to read, i.e., view the contents of the file.

Write

Grants the capability to modify, or remove the content of the file.

Execute

User with execute permissions can run a file as a program.”

Tying this back to NFC & QR codes with the application being payments; the execute command is the ability to transfer value. This is happening on the internet too with cryptocurrencies & Web3.

I digress. Fixating on the User with execute permissions can run a file as a program. In the NFC & QR payment world, the user executes a command to transfer information or value & not just to view & modify content. This has not happened in isolation for consumers. The rise of the smartphone & the work of payment networks like Visa & Mastercard has created an environment for these technologies to exist.

Co-dependencies – The chip & The camera.

As you have probably discovered, NFC & QR code have co-dependencies in the form of two-way devices with embedded chips for NFC & a scanner in the form of a camera for QR codes, with the passive code on the other side of the interaction of course.

The chip & the camera play a vital role in enabling the consumer use case for NFC & QR codes.

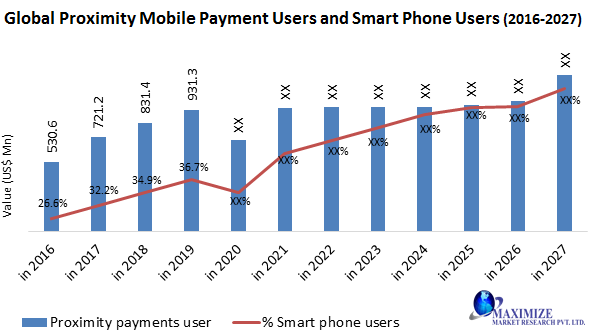

These have created a co-dependency, the rise of in-person mobile payments (known as contactless payment) has been in conjunction with the rise of smartphone adoption.

Convergence on payments – pay & get paid

Mobile-based NFC has converged on payments. Due to the nature of NFC being both active & passive, NFC devices have largely been used as a way to pay. This, in part, is due to mobile phone manufacturers (Apple, Samsung) & operating systems (iOS & Android) embedding the technology within devices & promoting the application as a payment mechanism (Samsung Pay, Apple Pay & Google Pay). But I must say the adoption of mobile-based NFC contactless payments has been largely low in South Africa. Google pay does not have a presence in South Africa, Apple pay launched a couple of months ago during a pandemic which creates a bit of friction when paying with masks & all. Samsung pay has been around the longest doing 3 million transactions a month. In the greater payment ecosystem, that’s a fraction of card payments. Plus Samsung Pay is restricted to a small number of mid-to-higher end devices which cuts out the mass market.

On the other end, payments are not even the highest use case for QR Codes – in developed markets. (sorry, application, forgot about the use case thing). The main applications have been to access information.

But there’s a clear convergence on payments. Touching on the idea of pay & get paid which we will tackle as the basis of this article. QR codes as passive transponders create a network between the customer & the merchant. The customer has the reader i.e phone camera & the merchant has the code i.e transponder. It’s logical that for restaurants, retailers, cinemas, doctors, the transportation industry (& even the product itself) can be gateways that lead to payment.

Closed-loop system vs 4-party System

Recently, Square – the American payments company launched CashApp pay, which was largely received as closing the loop.

What is closing the loop? in fact, what is a closed-loop system? A closed-loop system is when payments are circulated within an ecosystem of 3-parties. The Customer, the Payment Service Provider (PSP) & the merchant (banks are always lurking in the background). Examples of this are MPesa, Alipay, WeChat Pay, & even PayPal. In contrast to a 4-Party model, which includes the acquiring (merchant’s bank), Issuing bank (customer’s bank) as well as the card networks (Visa, Mastercard etc).

Going back to Square closing the loop. Most QR payments players operate in a closed-loop system. That is why the highlighted product for CashApp Pay is the QR code. In the African context, Telco’s mobile money closed-loop beats the 4-party model of Visa & Mastercard in some nations, where the leapfrog of cards & co-dependencies on phones, in particular, created the environment for such.

The best case for inference is China. Where Alipay & WeChat pay are the dominant payment providers. The core difference between closed-loop Africa & closed-loop China for adoption is the dominant co-dependency (feature phones vs smartphones, telcos vs tech giants).

Climbing off the closed-loop tangent, & going back to mobile-based NFC. Because mobile-based NFC is built on top of the interoperability of the 4-party system & where the underlying infrastructure has been the smartphone. In this case, what happens is the phone (eg. iPhone) tokenizes the card & becomes the wallet.

These two technologies, though they create the same use case with the co-dependencies (close proximity payments) are quite divergent in the application.

Ukheshe’s pay & get paid

I haven’t touched much on the QR payment market in South Africa. Like most other consumer markets it’s dominated by 3 payers;

SnapScan

Zapper

Masterpass (Ukheshe)

Each of these companies probably needs a newspaper post of their own, but let’s keep it simple & talk about the last one.

A couple of weeks ago I came across a LinkedIn post by Ukheshe CEO Clayton Hayward displaying a new card with a QR code on top.

The convergence of NFC & QR intrigued me. As what happens when curiosity kills the cat I dug in the best way I know how; by asking questions from people close to it. These are the following answers' I received;

"Prepaid card & QR code are linked to the mobile wallet where the mobile number is the “account#”, the common denominator. The thinking of combining the two is also to reduce issuing two cards. when purchasing the customer can swipe &/or scan all funds are deducted from one place”

“Use case: parking guard pulls out this ukheshe prepaid card, driver scans the QR code to tip for parking (using any masterpass enabled app). @ the end of the day guards goes to the store to swipe &/or tap for groceries (access to markets that don’t accept QR but have a POS)”

The reason:

“Convergence of QR code ( get paid ) & contactless/chip card ( pay ) all linked or settling not the same wallet account. It reduces the cost of acceptance for micro-merchants whilst growing access to bank accounts”

I think this is a good time to take a step back to understand Ukheshe. Ukheshe, as defined by Crunchbase as a micro micro-transaction platform that allows uses to #getpaid. That doesn’t quite explain the business. Let’s go a little deeper.

Ukheshe was built out of a software development agency called Jini.Guru. The initial platform was to build a low-cost transaction payment platform for consumers to get paid. The first use case was allowing parking guards to accept QR payments. After two years of running that & finding the challenges with the business, Ukheshe decided to pivot into being a platform business for other businesses to issue & accept QR codes & prepaid debit cards. The acquisition of Oltio, the main developer of Masterpass in South Africa, arguably the biggest QR payments player in the market because of banking partners & distribution, allowed Ukheshe to deeper entrench itself within the payment ecosystem.

Ukheshe has been aggressively building its platform (What they call Eclipse).

The Ukheshe business is impressive, despite the pivot – pay & get paid is interesting when you think about it from the angle of wallet-less payments. In a market like South Africa where the financially disincluded (not a word but sounds nice) are not necessarily looking for inclusion, providing a cash-in/ cash-out solution for micro-entrepreneurs with low barriers to entry is important.

Throughout this piece of writing I alluded to NFC being embedded on debit & credit cards, needing to contrast it directly with QR codes to make mobile devices the focal point. The reason is that wallet-less payments are more interesting. As the phone becomes the article of choice in payments across the world the future of pay & get paid becomes much more interesting in the digital sphere.

Are applications expanding?

That was an anti-climatic ending, I apologize. But before we leave each other I want to touch on one last thing. The expanding applications for NFC & QR codes? Not the high velocity, lower technical applications like scanning to access static restaurant menus or QR codes for marketing purposes, rather, the highly technical ones where NFC & QR are the interfaces for a broader platform.

First payments. In payments, the more interesting thing happening around these technologies is at checkout;

Moving from the merchant level to the product level checkout – consumers are now adding products to carts & paying without having to go through payment terminals for individual scanning of items. Examples:

Next, Healthcare. We predominantly touch on NFC & QR as a payment mechanism, but the technology is moving across industries to healthcare as well where the main application is;

Identity – The identity layer is very important in healthcare, moving away from paper-based files to electronic documents where the consumer is in control. Plus, let’s not forget vaccine passports.

Last, Transportation. Apple Pay is widely used as a payment mechanism for trains in the UK. The other use case, for QR codes has been;

Alas, I’m interested to learn more about other applications beyond mobile-based payments. If you know some, ping me.

Cheers.

The History of RFID by Mark Roberti

Shrouds of Time - The History of RFID

The History of the QR code