Bitcoin, Ethereum, Cryptocurrency, Decentralized Finance & Why you should care.

The Bitcoin white paper1 came out over 12 years ago & since, Bitcoin & its underlying protocol, the blockchain has changed the world & the minds of its smartest people. I first heard about Bitcoin in July 2013. My friend Thapelo & I were talking about his small investment portfolio with one of the investment companies here in South Africa (thanks to a cash gift from his grandmother). We were contemplating taking it all out & buying bitcoin. We had no idea how bitcoin worked. All we knew was that it was internet money that was changing the world — at least to the nerd circle we knew. We were sold but had no idea how to buy bitcoin. Mt Gox was the most popular trading platform back then but we still had no idea how to do it so we let it go.

Fast forward to 2017 & the world was in an ICO frenzy. In August 2017, Thapelo gave me a call, the price of Bitcoin passed $3000 for the first time on August 5th, by August 12 it was up 60% at $5000. Around the time Thapelo called 1 Bitcoin was equivalent to R40 000, he said we should go half/half on one. I did not have R20 000 or any disposable income so I passed & we ended up not buying. December 19, 2017, the price of bitcoin sat at $19,783.06. If Thapelo & I had bought & sold at the peak we would have netted an ungodly RoI. But we were speculators (broke speculators) & true enthusiasts bet the long-term.

Sitting at home in now — 2021 & being overcome with genuine curiosity about the world of cryptocurrency again & how far Bitcoin has come from the humble beginnings of a peer-to-peer digital currency.

I normally drift in & out of an obsession with topics, but if you follow me long enough you’ll know my obsession is mainly at the intersection of Finance & Technology, better known as FinTech. I was fortunate enough to do a very short stint at one of South Africa’s most successful FinTechs, which I’m forever grateful for. But my curiosity has never left me. So recently I dived into the world of cryptocurrencies & the whole Decentralized Finance (DeFi) as a spectator at first but now, more & more as a believer of what will be possible will Open Finance or better yet — Decentralized Finance.

Bitcoin & The Boom-Bust Cycle: 2010-2017

Bitcoin

Let’s recap; what is Bitcoin? Bitcoin is an open-source peer-to-peer currency that is used to transfer value on the internet on an open, distributed digital ledger called the Blockchain. What does that mean? That means that Bitcoin is an immutable money system that is native to the internet. A money system that is open by default, is not controlled by one person & lives natively on the internet.

Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions & the issuing of bitcoins is carried out collectively by the network. Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin & everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system. - Bitcoin.org

Bitcoin runs on the Blockchain; The Blockchain is a timestamped list of records of transactions that are immutable (cannot be changed) by design. The Bitcoin blockchain is default public, meaning that anyone can verify the records of each & every transaction. The reasoning behind this was to curb the double-spending problem, to make sure that the earliest transaction was the one that counted & that requires everyone (the miners, we’ll get to them) to agree (consensus) on the single history of the order in which transactions were received – timestamping.

How does timestamping work?

The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received…The solution we propose begins with a timestamp server. A timestamp server works by taking a hash of a block of items to be timestamped & widely publishing the hash, such as in a newspaper or Usenet post [2-5]. The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it. - Satoshi Nakamoto

To simplify it for us non-technical people, let’s take the Wikipedia definition of what timestamping is then logically apply it to computing:

A timestamp is a sequence of characters or encoded information identifying when a certain event occurred, usually giving date & time of day, sometimes accurate to a small fraction of a second. The term derives from rubber stamps used in offices to stamp the current date, & sometimes time, in ink on paper documents, to record when the document was received. Common examples of this type of timestamp are a postmark on a letter or the "in" & "out" times on a time card. - wikipedia.

Now, there is a catch, to implement this timestamp it needed a distributed timestamp server to validate the transactions. Satoshi chose to use a system called Proof of Work. Proof of Work is a cryptographic trust mechanism where one person proves the transaction happened & the other person verifies that indeed the transaction happened. Proof of Work is the basis on which miners exist & acts as the trust mechanism to reach a consensus that does not require ordinary people to trust each other for a transaction to happen.

For example, when you have to pay for a meal at a restaurant with your card, that transaction happens between 3 other parties besides you & the restaurant - Visa/Mastercard, your bank that issued your card & the restaurant’s bank that gave them the card machine that allows them to accept card payments. In this case, when you pay with your card, Visa/Mastercard pings your bank to ask them if you are good for it then passes that information to the restaurant’s bank to say, okay you’re good for it they can approve the transaction. After a few days your bank sends the restaurant’s bank the money for the meal you ate, the restaurant’s bank then sends the restaurant their money minus all the fees incurred in the transaction. This is called a four-party loop system & trust is required at every layer:

You need to trust your bank

Your bank needs to trust Visa/Mastercard

The restaurant’s bank needs to trust the restaurant

The restaurant needs to trust its bank

The restaurant’s bank needs to trust Visa/Mastercard

The banks need to trust each other.

This is all in order for you to buy a meal & the restaurant to sell it to you. & even after this, the system still carries the risk of fraud. This is not to say a proof of work blockchain fully solves the risk of fraud, it does have mechanisms to disincentivize it. Therefore requiring people not to trust centralized bodies but immutable code validated by distributed computers:

“Proof-of-work is essentially one-CPU-one-vote. The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest & outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block & all blocks after it & then catch up with & surpass the work of the honest nodes.” - Satoshi Nakamoto

The validation happens through a network of validators, called Bitcoin Miners (& no, tell your mother there’s no such thing as a bitcoin mining WhatsApp group). Bitcoin Miners decrypt & validate transactions, which requires them to solve mathematical equations (hashing) which take up CPU time & a ton of electricity. For this, they are incentivized with bitcoin + transaction fees.

Yes, all this happens anonymously via private & public keys. This is a critique that boomers have; the assumption is that private = illegal, which is incorrect & intellectually lazy. Only 0.34% of all cryptocurrency transactions were illicit in 2020, but there are scams that we need to address & we will, especially in the Republic of South Africa that has had the biggest scam of them all.

Bitcoin challenged & changed the privacy & trust model, like our restaurant meal example, where trust was outsourced to third parties like Visa/Mastercard & banks to one that trust is outsourced to a public blockchain. This fundamentally changed, at least at the base layer, what trust in a financial system should look like. Decentralized Finance (we will touch on this later) has taken this new trust model to new heights.

The Boom-Bust Cycle: 2010-2017

The early days of Bitcoin were cryptographers & early-adopters who believed in Satoshi Nakamoto’s idea & bootstrapped the network as miners. Then the first commercial use for Bitcoin happened on May 22, 2010, when a man by the name of Laszlo Hanyecz traded 10 000 Bitcoin for 2 large pizzas from a Papa Johns with a teenager named Jeremy Sturdivan on Bitcoinctalk.org.2

At that time trading happened on the first, now-defunct Bitcoin exchange - Bitcoinmaket.com3 The significance of that transaction created a fiat price discovery market for Bitcoin above the use case of just transferring Bitcoin. People further adopted Bitcoin as a speculative asset amongst early adopters. 2 months after that famous 10 000 Bitcoin pizzagate transaction a programmer by the name of Jed McCaleb decided to change his online exchange for Magic The Gathering cards (Magic: The Gathering Online aka MtGox.com) into a Bitcoin exchange.

Jed ran MtGox for a few months until he sold it to a French developer called Mark Kerpeles. From 2010 to 2013 MtGox became the most popular Bitcoin exchange, handling some 70% of all Bitcoin trades. The price of Bitcoin hit highs of $1165 per BTC by November 30, 2013. But under Kerpeles leadership, MtGox was extremely flawed, susceptible to hacking & lacking a quality user experience. The first boom of bitcoin was because of a myriad of activities, yes boomers, some were nefarious like the Silk Road scandal4. But the driving factor of bitcoin is pure economics; supply vs demand. There will only ever be 21 million Bitcoin mined, as the price of Bitcoin increases with speculation the supply further decreases with mining.

By 2014 it was clear that for Bitcoin to reach the mass market new exchanges need to be born. MtGox simply was not going to work. Coinbase had followed Kraken as the new cryptocurrency exchanges with the value proposition of security & ease of use. Allowing ordinary consumers to buy & trade bitcoin without needing to worry about the fear of losing their coins.

The boom of new crypto exchanges stretched across the world - at least in places where Bitcoin was not banned. In South Africa there were 2 companies helping banks & other financial institutions tinker with Bitcoin & Blockchain technologies, this was during the time of “Blockchain, not Bitcoin”. One was called Switchless, incubated by a venture studio called FireID run by the Joubert brothers, Malan & Philip Joubert. The other was an exchange called BitX, founded by ex-banker Marcus Swanepoel & ex googler Timothy Stranex. These companies decided to combine into one; a centralized exchange with a focus on helping ordinary consumers buy & trade bitcoin without needing to worry about the fear of losing their coins. The combined entity would later change its name to Luno, one of Africa’s largest cryptocurrency exchanges.

Centralized exchanges did the hard yards of trying to educate the public about Bitcoin & the role that cryptocurrencies will play in the future of finance. The increasing price of Bitcoin helped, as more & more people started speculating. & when the price of Bitcoin crashed again lots of speculators left but some stayed as believers to build new technologies. These boom & bust cycles helped with adoption & building in the run-up to 2017.

By 2017 the whole world was catching on to Bitcoin. Like I said earlier my friend Thapelo & I kept in touch during the frenzy. From August 2017 to December 2017 it was clear that we were in the biggest crypto bubble ever, the price of Bitcoin ballooned but there were new tokens & “currencies” being created every single day – these so-called alternative coins (altcoins) enhanced the crypto-mania & with it more speculation & with that the idea of easy money & scams. Until the bubble burst & all speculators lost their money, some lost their life savings in altcoins. So they left & builders stayed to build. This time, not new centralized exchanges. It had become clear that for cryptocurrency to enhance & fundamentally change the financial system, it needed to focus, not on useless coin offerings, but on protocols & immutable smart contracts5.

Vitalik Buterin’s Ethereum & Decentralized Finance

Vitalik Buterin is a Russian-Canadian programmer born on the 31st of January 1994. When Vitalik was 17 (2011) he discovered Bitcoin & will the persuasion of his father, he fully immersed himself in the field of cryptography & the growing field of cryptocurrency. In 2013 he took some time off to travel during the break as he attended the University of Waterloo to meet developers in this space & then he came back & published the Ethereum whitepaper6. With a $100 000 grant from the Thiel Fellowship, he began working on Ethereum.

Ethereum is an open-source decentralized blockchain with a native cryptocurrency called Ether (ETH), it’s written in a programming language called Solidity7. Ethereum introduced Nick Szabo’s concept of smart contracts:

The basic idea behind smart contracts is that many kinds of contractual clauses (such as collateral, bonding, delineation of property rights, etc.) can be embedded in the hardware & software we deal with, in such a way as to make breach of contract expensive (if desired, sometimes prohibitively so) for the breacher. A canonical real-life example, which we might consider to be the primitive ancestor of smart contracts, is the humble vending machine …. Smart contracts go beyond the vending machine in proposing to embed contracts in all sorts of property that is valuable & controlled by digital means. Smart contracts reference that property in a dynamic, often proactively enforced form, & provide much better observation & verification where proactive measures must fall short. - Nick Szabo

Smart contracts are digital contracts that automatically execute a predetermined set of instructions according to the agreed terms. These terms can be as simple as if x happens y must happen. What makes smart contracts novel is that they live publically on the Ethereum blockchain & they add a layer of trust which is digital & enforceable without the need for bilateral negotiation. What does this mean? this means that two people can engage in a transaction of property rights not with each other but rather with the contract itself. You don’t need to trust the other person, all you need to trust are the terms of the contract itself.

Vitalik’s beautiful brain came up with ways to increase the functionality & applications of blockchain technology in a manner that is decentralized & public. What the people who were building (some still are) private blockchains for banks & other institutions, the “Blockchain, not Bitcoin” club, failed to understand was the novelty of building a consensus protocol.

The intent of Ethereum is to merge together & improve upon the concepts of scripting, altcoins & on-chain meta-protocols, & allow developers to create arbitrary consensus-based applications that have the scalability, standardization, feature-completeness, ease of development & interoperability offered by these different paradigms all at the same time. Ethereum does this by building what is essentially the ultimate abstract foundational layer: a blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts & decentralized applications where they can create their own arbitrary rules for ownership, transaction formats & state transition functions. A bare-bones version of Namecoin can be written in two lines of code, & other protocols like currencies & reputation systems can be built in under twenty. Smart contracts, cryptographic "boxes" that contain value & only unlock it if certain conditions are met, can also be built on top of our platform, with vastly more power than that offered by Bitcoin scripting because of the added powers of Turing-completeness, value-awareness, blockchain-awareness & state. - Vitalik Buterin.

Vitalik & the Ethereum team took a modular & composable approach in building a new blockchain. To; “allow developers to create arbitrary consensus-based applications”.

The Applications:

Token Systems

Financial Derivatives & Stable-Value Currencies

Decentralized File Storage

Decentralized Autonomous Organizations

Savings wallets

Crop insurance

A decentralized data feed

Smart multi-signature escrow.

Cloud computing

Peer-to-peer gambling

Prediction markets

On-chain decentralized marketplaces

Vitalik accurately predicted most of the above applications. Ethereum launched in 2015 & grew in popularity. Even the “Blockchain, not Bitcoin” crowd led by IBM started to test on Ethereum. By 2017 Ethereum was the bedrock of new token issues. The project has not gone without its fair share of criticisms from the Bitcoin Maximalist crowd. In 2016 Ethereum had to do what is called a hard fork in order to save investors from a failure in a smart contract of an entity called The DAO (Decentralized Autonomous Organisation). A controversial act in the crypto world but Ethereum’s modularity & composability has played an important part in the rise of what’s called Decentralized Finance (DeFi). We’ll touch on DeFi just now but first, we need to further understand how Etherum exists.

Ethereum’s protocol exists to keep a continuous immutable state. What does this mean?

Ethereum's state is a large data structure which holds not only all accounts & balances, but a machine state, which can change from block to block according to a pre-defined set of rules, & which can execute arbitrary machine code. The specific rules of changing state from block to block are defined by the EVM (Ethereum Virtual Machine). -ethereum.org8

The Ethereum Virtual Machine (EVM) is analogous to a ‘distributed ledger’ but made more sophisticated by the introduction of smart contracts. EVM is the execution model9 for transactions on smart contracts. This incurs a cost, called a gas fee. Think of the gas fee (named gwei) as similar to a transaction fee. Gas is important for the operation of the Ethereum network, it is the cost of computational effort. So the higher the required computational effort the higher the price of gas. This causes problems for the scalability of the network as blocks get filled. The other problem – at least for me at the current gas prices; DeFi participation excludes most people in the emerging market from participating in the upside. But hold that thought & the idea of the EVM & it is composability. It becomes important for the next section.

“Gwei is equal to 0.000000001 ETH (10-9 ETH). For example, instead of saying that your gas costs 0.000000001 Ether, you can say your gas costs 1 Gwei” -ethereum.org

Decentralized Finance (DeFi)

I have been thinking about decentralized finance for a while now & I’ve gone deeper – out of pure curiosity & now bordering an obsession. First, what is decentralized finance?

The term decentralized finance (DeFi) refers to an alternative financial infrastructure built on top of the Ethereum blockchain. DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, & transparent way” - Fabian Schär10

Decentralized Finance (DeFi) is a new financial infrastructure being built on top of a Blockchain, in this case on top of the Ethereum blockchain. It is meant to be transparent, modular, composable & immutable with the use of smart contracts. This new infrastructure in most cases is a mimic of what exists in today’s financial system – mostly resembling the traditional capital market.

The difference on a theoretical landscape is that unlike traditional capital markets, DeFi participation is open & transparent, there are no intermediaries, the developers are the new bankers & the bank is in itself code. Traditional institutions like exchanges, hedge funds & banks are now protocols & decentralized applications known as DApps. People no longer enter into agreements with centralized institutions to access financial products, they simply partake in transactions governed by smart contracts. Institutions themselves are being decentralized by changes in the governance structure & function. This is done through community governance, as opposed to agent-governance we see in Corporates, where the community votes on changes to the protocol.

This may sound obscure & widely peculiar, why would the world need another financial infrastructure? What is wrong with what exists today? Well, that’s not entirely the right way to think about it. A large portion of the global population is spending more time on the internet, for some their internet life is how they make their money. So it seems that the internet itself needs a native financial infrastructure to accommodate those who are spending more of their lives on it.

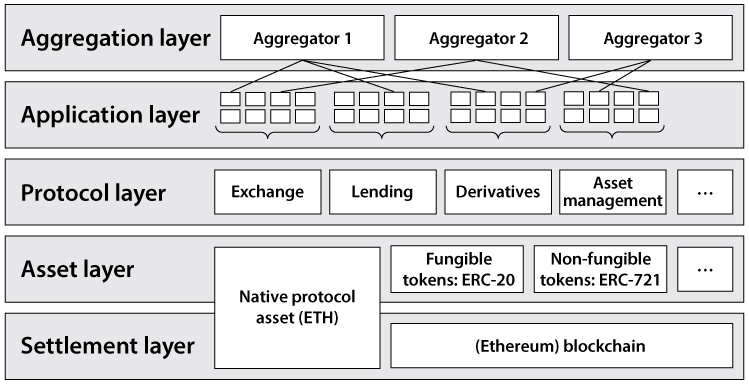

I will try to explain this more in detail, but first, let’s look at the building block of DeFi: The DeFi stack

As we have discussed, this new financial infrastructure is built on top of the Ethereum blockchain & its native cryptocurrency; Ether (ETH).

The Ethereum Blockchain & Ether make up the settlement asset layer with standardization for token offerings; ERC-20 is for fungible tokens, tokens that are 1-to-1 like a ZAR 50 note is fungible, it is equal to another ZAR 50 note. ERC-721 standard is for non-fungible tokens (NFT), unique indivisible digital assets like digital art; a LeBron James video, a Beeple portrait etc. NFTs have attracted a lot of interest over the last couple of months but they have been around for a few years.

The protocol layer is the most interesting in DeFi. This is where the reinvention of the financial markets is happening. New decentralized mimics or traditional finances like exchanges, lending markets, derivative assets, asset management; all happening in an interoperable & permissionless manner on the blockchain. Just thinking about the application of this hurts my head. How do you effectively run a hedge fund as a decentralized autonomous organisation, run through smart contracts, governed by a community? I don’t know, my head hurts, but they exist.

The application layer is the interface layer that you & I see. Applications can be the extension of the protocol itself that makes the protocol intuitive to use to the average human. This can be a website that allows people to connect their Ethereum wallets

On top of the application, layers are aggregators, these can be tools that aggregate multiple protocols onto one user interface also known as the on-ramps to DeFi. These are wallets like Metamask, Coinbase Wallet & Zerion etc.

Professor Fabian Schär goes deeper on each layer in his paper but for the purpose of this article, I think those explanations were sufficient. I want to explain the importance of a new & open financial system, even if it’s currently opaque to ordinary people.

We have had the current financial system for decades. At least since Nixon ended the Bretton Woods system in 1973. I previously wrote about this here. At the macro level, we have been running on Keynesian economics since the mid-1900s & the money system dates back to the late-1700s11. Governments have had an imperial-style influence on monetary policy that governs today’s fiat money system. But currencies fail.

When currencies failed

Over the last 50 years, 10 fiat currencies have failed due to hyperinflation:

Chilean Escudo - 1975

Argentine Peso - 1985

Peruvian Inti - 1991

Yugoslav Dinar - 1992, 1993, 1994,

Angolan Kwanza - 1995, 1999

Belarusian Ruble - 2000, 2016

Venezuelan bolívar - 2007, 2017

Zimbabwean dollar - 2009

source: mint.com

All these failed currencies show how fickle the value of fiat currency is. it can be one thing today & another thing tomorrow. All that matters is trust, trust in the system & when trust in the system fails so does the currency. The reason that cryptocurrencies as an asset class exist is because of the fragility of the current financial system. The reason DeFi exists is that a monetary incentive is the most powerful incentive & people' have found a better way to organize capital that does not place trust in a centralized system but trust in a decentralized immutable one. In the age of the internet, this is important. The difference between sending a letter & email is huge. The difference between the amount of information available today vs pre-internet is huge. The difference between communication today vs communication pre-internet is huge. It is not a foregone conclusion that DeFi will work, but a native financial infrastructure on the internet has the chance to be massive.

Why you should care

Opportunities in DeFi

Cryptocurrencies are here to stay, it is still early days in terms of use cases especially in the emerging markets. Crypto startups are a community-driven initiative mostly by curious tinkerers. One of the most successful decentralized exchanges; Uniswap, was developed by one person; Hayden Adams. One of the hottest Ethereum based projects of last year; Yearn Finance, was developed by one person in Cape Town; Andre Cronje. Crypto startups are built by curious groups of small teams. The opportunity exists because the infrastructure exists. There is still a sense of wilderness & obscurity in this space. It is nascent but builders should build. We (Africa) deserve to participate in the upside.

Bitcoin is digital gold

Bitcoin failed as a peer to peer currency but succeeded as a digital representation of gold. If you never care about anything in this space but Bitcoin, you would still be in good stead. Bitcoin is a long term store of value

Hypergrowth

Total Value Locked in DeFi (TVL), a measure of how much collateral is locked in DeFi contracts is seen as an important metric for the adoption of projects. Since 2018 TVL has grown from 0 to almost $50 billion.

source: DeFi Pulse

Regulation

Regulation is an important element to increase the adoption of cryptocurrency as an asset class. There have been calls around the world for more clarity from regulators in the classification of cryptocurrency. Some markets in Africa have prohibited the trade of cryptocurrencies, some have no official stance but others have been progressive in communicating their stance.

source: BakerMackenize

The South African regulators under their Intergovernmental Fintech Working Group (IFWG) innovation hub released a position paper12 in April of 2020. In it, they stated their desire to regulate crypto assets in six categories as Crypto Asset Service Provider (CASPs):

Crypto asset trading platform (or any other entity facilitating or providing the mentioned services)

Crypto asset vending machine provider

Crypto asset token issuer

Crypto asset fund or derivative service provider

Crypto asset digital wallet provider (custodial wallet)

Crypto asset safe custody service provider (custodial service)

There have been more calls for the regulator(s) to move faster in clarity around the enforcement of regulation as more nefarious activities find their way to retail customers. Institutions themselves are waiting for the green light to invest in Bitcoin, which will further help the adoption of cryptocurrency as a mass-market asset class.

Why you should not care

Risk of hacks & Scams

For DeFi, there is a high risk that smart contracts have bugs, get hacked & investors lose their money. Because it is still early days in this space, that risk is a bit high at the moment. There were 15 projects that were known to be hacked in 2020 because of smart contract bugs & investors lost $120 million.

South Africa faced the biggest scam of 2020 where investors lost $588 million in a fraudulent entity called Mirror Trading International (MTI) fronting as an investment entity that uses a proprietary trading algorithm that helps customers achieve a 500% per year return. South Africa is a country with a population that suffers from a ‘get rich quick’ illness. This is why regulation & oversight is important.

Scalability

The biggest knock on the DeFi space is the scalability of the Ethereum network or lack thereof. Currently, because of the growth in projects built on top of Ethereum, the cost to fulfil a transaction has gone up which disincentivizes small-scale participation by retail investors in favour of large fund traders. There has been progress in layer 2 solutions with things called zk-rollups with zero-knowledge proofs & optimistic rollups. This should ease the pain of high gas fees.

If that does not interest you, then of course you should not care.

Opaqueness

The DeFi space is very, very nascent, therefore the things being built are fairly opaque. But:

“What the smartest people do on the weekend is what everyone else will do during the week in ten years”- Chris Dixon

Lack of real-world applications

The last one is around the use case. The most important questions are, who’s the customer? & what does the customer do with this? This question has been answered for Bitcoin, it’s a long-term store of value to the customer & the market is everyone including institutions & governments. For DeFi it is still unclear how the retail investor can effectively participate in this market, I have my own assumptions but it is still early, you should not care but if you do, pay attention.

Take care

If you enjoyed this piece or if you enjoy my writing consider buying me an American price coffee -> buymeacoffee.com/ububele

Disclosure notice:

Ububele hodls some Bitcoin & Ethereum in his personal capacity. This content is for informational purposes only, you should not construe any such information or other material investment or financial advice. Nothing contained on our site constitutes a solicitation, recommendation, or offer by Ububele to buy or sell any Bitcoin, Ethereum or other financial instruments.

Today's newsletter is 💯 ( a crash course for crypto beginners)

Hi Ububele, just finished reading this article, have you been able to answer tis question yet? How do you effectively run a hedge fund as a decentralized autonomous organisation, run through smart contracts, governed by a community?