WeBuyCars — South Africa's Used Car Market & The Platforms That Power It

The Market; The Outsiders — WeBuyCars; The Goliath — OLX Group & The Aggregator — Cars.co.za

Hello there, Welcome back. If you are new, each week I write about tech-enabled startups in South Africa, or how certain technology trends might be relevant to South Africa & sometimes the founding story of innovative companies. I’ve been off the last two weeks but I’m back. This week let’s tackle the used car market. With interesting companies globally in this space, the likes of Carvana, the used car vending machine company founded in 2012 & now worth over $34 billion & the UK’s Cazoo, the fastest UK company to a $1 billion valuation. Used car salesmen are still relevant—somewhat.

The Market

Cars are bought not sold but used, used cars are SOLD not bought. The used car market is fragmented, lacks trust & transparency & quite nefarious (If you know which type of cars go ‘missing’ daily, the top 10 list of used cars sold won’t shock you).

The automotive industry accounts for 6.9% (4.4% manufacturing and 2.5% retail) of South Africa’s GDP with an aggregate market value of just over R500 billion a year (~$29 billion). Naamsa, The National Association of Automobile Manufacturers of South Africa (yikes! that was a mouth full) disclosed that 536 611 cars were sold 2019.

According to Transaunion’s Vehicle Pricing Index (VPI), the ratio of used cars to new cars sold is around 2.35:1 as of Q3 2020, meaning for every 1 new car sold, there 2.35 used cars sold. Car sales are a good measure of economic mobility, as of Q3 2020 more than 39% of cars financed are above R300 000 (~$17 600). South Africa has an over-zealous credit economy, if I can put it that way, so a market with predictable purchasing behaviour & such a volume is quite lucrative. This leads to fragmentation & nefarious behaviour for market share.

source: transunion.com

The Outsiders — WeBuyCars

So how does one disrupt such an industry?

Change the user experience.

Use technology to accomplish number 1.

WeBuyCars was founded by Faan van der Walt & his brother Dirk in 2001. Faan, a school teacher & Dirk the dreaming marketer had an idea to buy & flip cars. Initially, the brothers did it as a hobby but when Faan & his wife came back from the UK in 2001 they went full time. For the first 16 years, the business was self-funded but grew revenue by over 60% YoY. Faan was adamant on not hiring experienced dealers but people from peculiar backgrounds & with knack for negotiating.

The combination of skill & dedication to giving the seller a fair deal, allowed WeBuyCars to gradually grew footprint by having a 1-to-1 relationship with the seller while remaining scrappy (excuse the pun). It was only after 8 years into operation that the company acquired physical premises, which is counter to the industry method of expanding footprint through dealerships.

The van de Walts adopted technology as a means to automate the buying process but funny enough up until 2018 the company kept all inventory records on Excel. This is when WeBuyCars began to automate things. First, by building an Inventory Management System (IMS), then, business intelligence tools to provide real-time insights. They used the data they had to build propriety pricing algorithms, as well as a pattern-matching tool to detect fraud. This has helped WeBuyCars trade over 5000 cars a month through the platform.

Around this time WeBuyCars caught the attention of Naspers—having owns numerous used car platforms around the world as well as Autotrader, the South African online used car marketplace. The acquisition of WeBuyCars would add to its existing OLX group. The purchase price? R1.4 billion (~$82 million). Earlier this year the Competition Commission blocked the deal on anti-competition grounds but the van de Walts went on to sell 49.9% of WeBuyCars to Transaction Capital for R1.89 billion (~$111 million) in September, valuing the company at R3.69 billion (~$217 million) — even better outcome for the brothers.

The Goliath — OLX Group

OLX was founded in 2006 by Fabrice Grinda and Alec Oxenford as classified site inspired by the American Craiglist site. OLX had been around for 4 years when Naspers acquired it for some $20 million-$40 million. The next 8 years OLX would acquire dozens of companies, adding to the network of classified sites & other marketplaces.

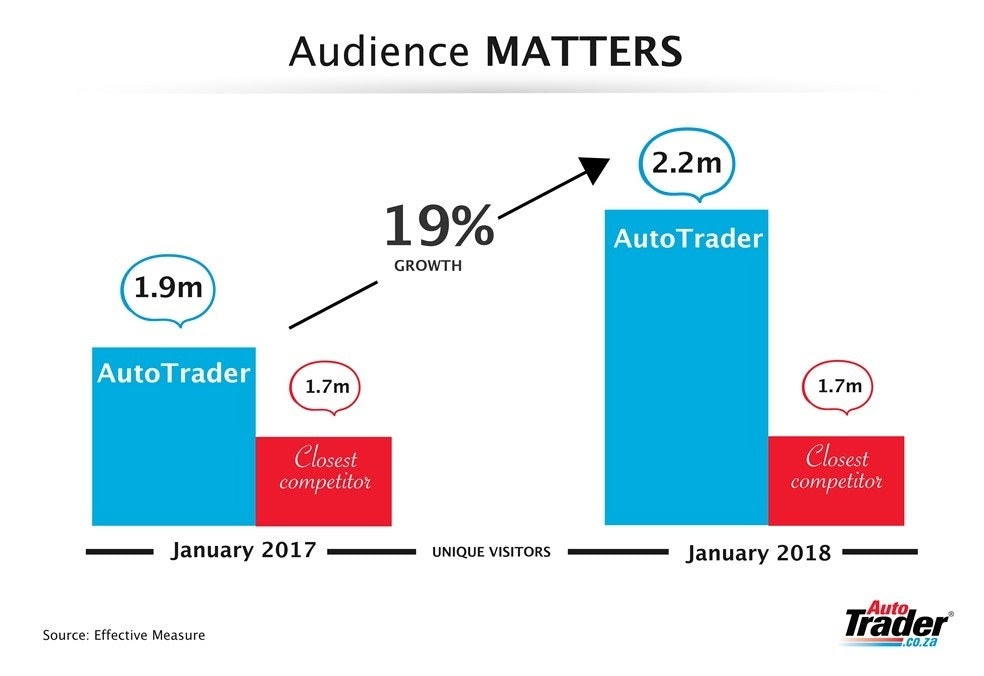

In 2017 the OLX Group moved into the online used car market. First with the merger of Autotrader.co.za with OLX. Then the OLX Group through its subsidiary, Dubizzle, acquired WeCashAnyCar and ExpatWheels in 2018. Autotrader began as a classified site for used cars but morphed into an online site for car buying. The synergies made sense for OLX, The group had owned the Romanian classified site Autovit since 2009.

In late 2019 OLX invested $400 million into Berlin-based online car marketplace, Frontier Car Group (FCG) which owns Nigeria’s Cars45, solidifying its intent to expand from just car classifieds to online marketplaces by cornering the market.

The tactic led to the Competition Commission blocking the WeBuyCars deal on anti-competition grounds because Naspers already owned a significant share in the Frontier Car Group (FCG) & Autotrader, which would leave Cars.co.za. as the only competitor.

The Aggregator— Cars.co.za

Cars.co.za is an online marketplace for new & used cars. Founded in 2010 by tech surf bros Ross McIlroy & Alastair MacMurray. Ross & Alastair ran Waxed, a web development agency & took on Cars.co.za as a client but then got fully invested & decided to take it over & pivot into a marketplace. Over the next 10 years, Ross & Alastair built Cars.co.za into the biggest car marketplace in South Africa not named Autotrader.

Cars.co.za set out to aggregate dealerships onto one platform & connect buyers & sellers of cars. Using a listing & ad revenue model where the seller pays per listing or a monthly listing fee if the seller is a dealership. The company believed to compete it needed to be asset-light & have multiple revenue streams. To differentiate themselves, Cars.co.za set out to build rapport with buyers through content & brand marketing, building a brand around Cars.co.za using their blog & YouTube as the main channels for brand marketing.

Cars.co.za has the second-largest selection of cars with over 70 000 in total & continues to grow in the shadow of Autotrader’s web traffic.

Platforms & marketplaces don’t exist in isolation. There needs to be willing buyers’ & willing sellers’ & most importantly willing financiers. Despite the economy not growing, R10.2-billion (~$600 million) worth of used cars were bought January, that number would decrease by 99% in April due to the lockdown but the market regained its strides by June. 25 000 used cars worth R7.3 billion(~$429 million) were sold in June. The recent numbers? 37 403 NEW cars were sold in September. The most logical step in the process we should ask ourselves is — who’s financing these cars? is there an adjunct market here that will be disrupted? We are told millennials are buying fewer cars or waiting longer to buy one. This is supported by the Naamsa numbers, passenger cars numbers have been declining for the last 4 years. This means the financiers are under pressure. If car ownership is no longer the ultimate goal of a young adult, what is the alternative? Uber everywhere or rent-to-own? let me know if you have the answer.

Take care.

USD/ZAR: $17/1