Issue #30: Hello there, Welcome back. If you are new, welcome to you too! Each week I write about tech-enabled startups in South Africa, or how certain technology trends might be relevant for South Africa & sometimes the founding story of innovative companies. This week I want to tackle Tymebank. Tymebank recently raised $110 million from foreign investors to scale their kiosk banking into the Philippines. Tyme has come a long way; from being a project between Deloitte Consulting & MTN back in 2012, to being a global challenger banking group.

Take Your Money Everywhere

TYME – which stands for 'Take Your Money Everywhere' was spun out in June 2012 by a team within Deloitte Consulting, led by Coen Jonker & Tjaart van der Walt, as a mobile money remittance operator funded by MTN to provide technology to retailers that enable them to offer local remittance services cheaper than banks. Rolf Eichweberas joined as the third co-founder.

In November 2012, Tyme signed the South African Bank of Athens (now GroBank) as the banking partner & Pick n Pay as a customer. The idea was to use mobile money as the conjugate for remittance inside South Africa through Pick n Pay & Boxer Superstores.

“Mobile Money is a simple day-to-day transactional account that gives you access to your cash anywhere you are and at any time. Send money, buy airtime and electricity or deposit and withdraw cash at all Pick n Pay and Boxer till-points, at no monthly fee and no minimum balance to activate. All you need to qualify for Mobile Money is to be over the age of 16 and have a valid South African ID number.” - Tyme 2012 website (source BusinessTech)

The investment & partnership with MTN allowed Tyme to tap into MTNs customer base & offer them several services for free vs non-MTN customers. These were the days before MTN's Momo account. So with the 3 partnerships; Athens bank as the banking partner, Pick n Pay Group for cash-in, cash-out services & MTN for customers – Tyme built the technology to convert cash at one till into mobile money & back to cash at the other till for the remittee.

Part of what Tyme built was a core banking system. So in 2013, they signed a partnership with Ebank to build a low-cost digital bank in Namibia. The digital bank was launched in 2014 but Tyme had to sell out of the joint venture after they were acquired by The Commonwealth Bank of Australia (Commbank or CBA) in January 2015 for AU$40 million (~R365 million). At the time – Tyme held a 38.3% stake in EBank, which they sold to PointBreak an Investment company in Namibia.

TymeDigital to TymeBank

Commbank bought Tyme for the team & the core banking platform that they had built. The idea; to use the existing technology & build a retail bank. So in October 2015, Rolf Eichweberas led the application for a retail banking license. The next 2 & a half years were tumultuous for Tyme but important for their future. It took them 2 years to get a full banking license from the South African Reserve Bank (SARB) but they continued to solidify their partnership with Pick n Pay – first by signing a money transfer partnership for a remittance product in May 2016 & then a 10-year distribution agreement in February 2017. Tyme was innovative & started building its proprietary kiosks.

Tyme – now TymeDigital received investment from South African Billionaire Patrice Motsepe, through his African Rainbow Capital (ARC), they bought 10% of TymeDigital from Commbank. Then in 2018, Commbank started to retreat from International markets to refocus on Australasia; very convenient timing for ARC who then signalled that they would buy Commbank’s 90% stake and launch the bank themselves. The transaction was completed in September 2018 & TymeDigital became TymeBank, signing up its first customers in November of that year.

The Kiosk

With the partnership with Retail giant Pick n Pay now intact & solid for the next 10 years – Tymebank aggressively rolled out their Kiosks:

Bank kiosks vary widely in price depending on the type you select and the features. They begin at around $3,000 for the hardware alone. Although, highly customized kiosks can cost as much as $25,000 to $35,000 each. The hardware is likely to cost you $3,000 to $8,000.

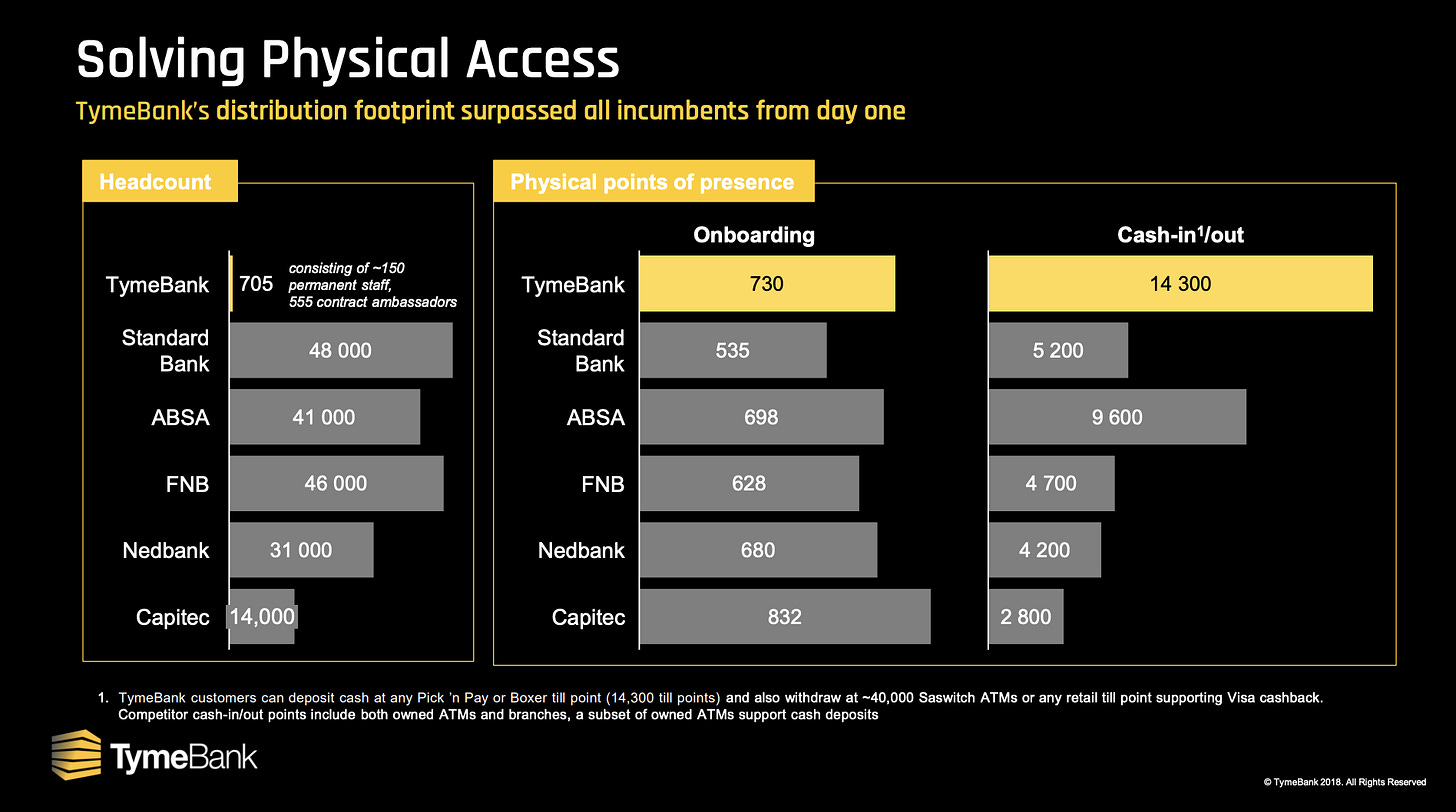

If we take the average price of a Kiosk at $5500 which is roughly R82 500. TymeBank has about ~850 odd of them in South Africa. So that would be $4 675 000 (~R70.1 million) for all of them. To date, they have onboarded 2.8 million customers which puts CPA (cost per acquisition) by kiosks at ~$1.67 (R25) per customer & decreasing with scale. Of course, there are labour costs incurred as Tymebank employs over 1000 ambassadors now, but such a low CPA makes the distribution of the kiosk a superior cost advantage.

It took Tymebank half a year to sign up 400 000 customers & by November 2019 they had signed up 1 million customers (50% 90-day active rate).

The target market for Tymebank has always been the mass lower-income population of South Africa. The hard to reach customer. The same strategy used by Capitec when it first came into the market. Tyme has managed to reach its intended target base:

“The bank’s customer analytics show that more than half its customers earn a salary of less than R5000 (~$333) a month, and 45percent of customers are older than 35,” the group said.

TymeBank has an Everyday transactional account and a GoalSave savings account. It said its customers have deposited about R500 million (~$33.3m) with the bank. The average GoalSave balance per customer is R4500 (~$300).

“The most common transaction type has been card swipes, which shows that customers enjoy earning smart shopper rewards. Following this, cash deposits at till points in Pick n Pay stores are the most common transaction type. This demonstrates that cash on hand is still prevalent within the bank’s target market segment,” - IOL

Tymebank has been spot on with its targeting.

Low-income households who live on $10 a day.

Want to save money

Cash on hand is important

As they move into lending, data becomes important for them, but they also have the privilege of taking a first-principles approach by being cautious about how they build their lending book.

TymeGlobal

After the acquisition of TymeDigital by Motsepe’s ARC they doubled down on the kiosks. TymeGlobal was created in 2017 as the international arm of Tyme, headed by its founders; Coen Jonker & Tjaart van der Walt. The idea; to be a multi-country digital bank & offer the kiosk as a service by partnering with banks in Asia.

In Indonesia, 150 TymeKiosks were deployed for our Indonesian bank partner. Their monthly customer acquisition rate has increased 7 times in less than 2 years. Cost per account opening is only 18% of branch cost per account opened.

In New Zealand, 130 TymeKiosks were deployed to re-KYC our New Zealand bank partner’s 700,000 customers to satisfy new KYC requirements.

Now, TymeGlobal is doubling down on its South-East Asia strategy with the recent funding from Apis & JG Summit, Tyme is applying for a banking license in the Philippines. A country with a population of 108 million and a GDP per capita of $3,485. They see similarities between their target market in South Africa and the Philippines. With Tyme’s Kiosk and modern banking stack built on Mambu, it will become interesting how they can scale the same way outside of South Africa. They seem to see more similarities in South-East Asia as opposed to the rest of Africa.

Tymebank will continue to onboard hundreds of thousands of customers each month in what people consider a crowded market but they have shown that there are different ways to go about building a bank and how to reach the end customers. Like most of the ‘scaleups’ in South Africa, Tyme has had a different journey to hyper-growth but has shown that narrative matters when building. Tyme is a 9-year-old company but the narrative is that Tymebank is a 3-year old challenger bank with 2.8 million customers with better distribution than most of its class of fellow digital banks & a superior cost advantage to the incumbent banks.

To the moon Tymebank.

Ububele`s am going to write exam by tymebank news letter thanks you very much for this brilliant idea that you wrote about tymebank news this one i enjoyed ...you opened my mind in the big way .

please send me more newsletter...normanm@oep.co.za

I really enjoyed this one as well Ubsta, thank you for you bud.