I spotted a trend of the same type of start-up popping up right after the other. The first one I spotted was SmartWage, founded in September 2019 by brothers Nick & Alex Platt plus a third gentleman named Simon Ellis. SmartWage is a real-time lender that allows employees to access a portion of their income earned during the month before payday without interest. I had seen the model a few years ago, pioneered by a company in America called Earnin, which I will talk about too.

The second company I came across was Paymenow, founded in August 2019 by Deon Nobrega & famous rugby player Brian Habana. Like SmartWage, Paymenow is a real-time lender that allows employees to access a portion of their income earned during the month without interest.

The third company I came across was Floatpays, too, founded in August 2019 & now part of Founders Factory Africa’s latest cohort, has the same model as the first two.

Payday lending is a contentious issue in any democratic country, more so in one that has R1.7 trillion (~$106bn) in outstanding consumer debt. I will tread very lightly on this topic & not impose my opinions, just state was is. Against popular belief, South Africans on average are fairly compensated, granted the distribution follows Pareto’s principle.

Well, maybe the mistake I made in the above statement was to say on average compensation is fair which is incorrect because average is not an indicator of fairness. Alas though, I am comfortable holding two contradictory statements at once & I can handle the cognitive dissonance.

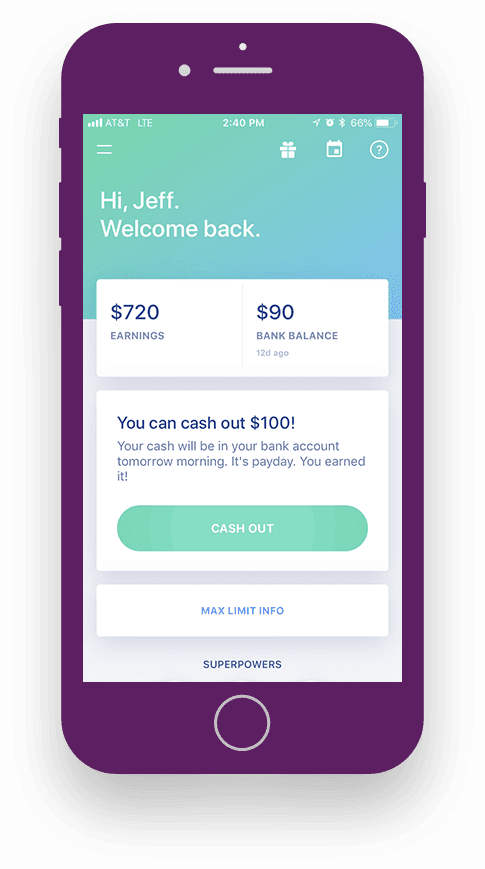

So Earnin,

Earnin was founded in 2013 by Ram Palaniappan to disrupt the payday loan industry in America under one idea he put forward in a Forbes article; “Society can be better”. He believed that America was a tale of two financial systems, “One helps the rich”, the other exploits the rest.” The idea of charging someone an exorbitant interest rate for a tiny loan for them to make it to the end of the month is maniacal. How Earnin works is that they advance a portion of income earned during the month to employees of companies at no fee or interest on the advance. The company believes that employees are entitled to access their income instantly for work done. Earnin makes money from tips given to the company by the community of users.

The Earnin model has attracted quite a few detractors for the way it operates. Earnin has avoided being called a payday lender because the company does not charge any interest on the cash advance.

How Earnin works: for the employee

Download the app, load all KYC docs + connect your bank account

Add your earnings information (Payslip)

Earnin calculates your daily wage or earned amount

You can unlock a no interest, no fees cash advance based on days worked

At your payday, they deduct the amount earned & ask you for a tip.

Essentially, what earnin does is payroll lending which has been around for decades. What these new South African players are doing is, in a way the same but differs in the distribution & revenue model.

Earnin is B2C mainly with a secondary B2B2C model. Earnin is community-driven meaning the tips form part of the pool of funds in which someone can get an advance. SmartWage, Paymenow & Floatpays operate a B2B2C model where they sell the value proposition directly to businesses rather than to consumers first. How they make money is important due to the Public Finance Management Act of 1999, which makes payroll deduction for the purpose of paying back a loan unlawful. Delivery of the product (in this case technology) differs but the idea remains the same.

How it works:

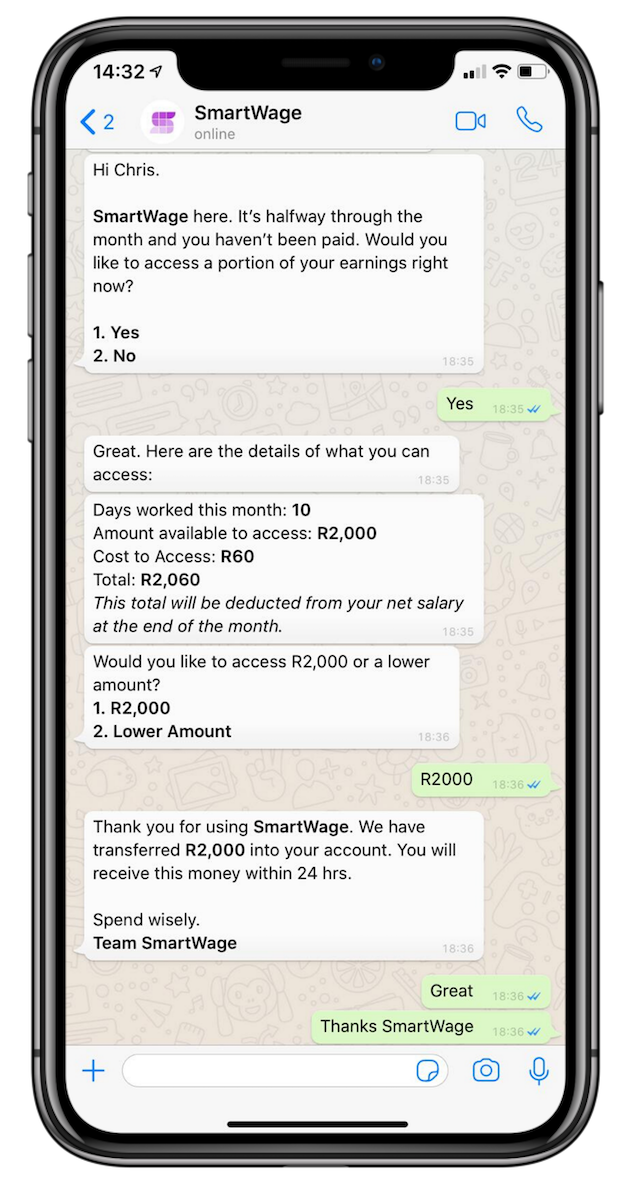

Let’s start with SmartWage;

Employers sign up & onboard all their employees’ information via an admin portal

To request an advance an employee can access their payroll information via a WhatsApp chatbot

Smartwage gives the employee an interest-free advance

At the end of the month, Smartwage reconciles the payroll for the employer

How Smartwage makes money is through a 3% transaction fee on the advance instead of interest.

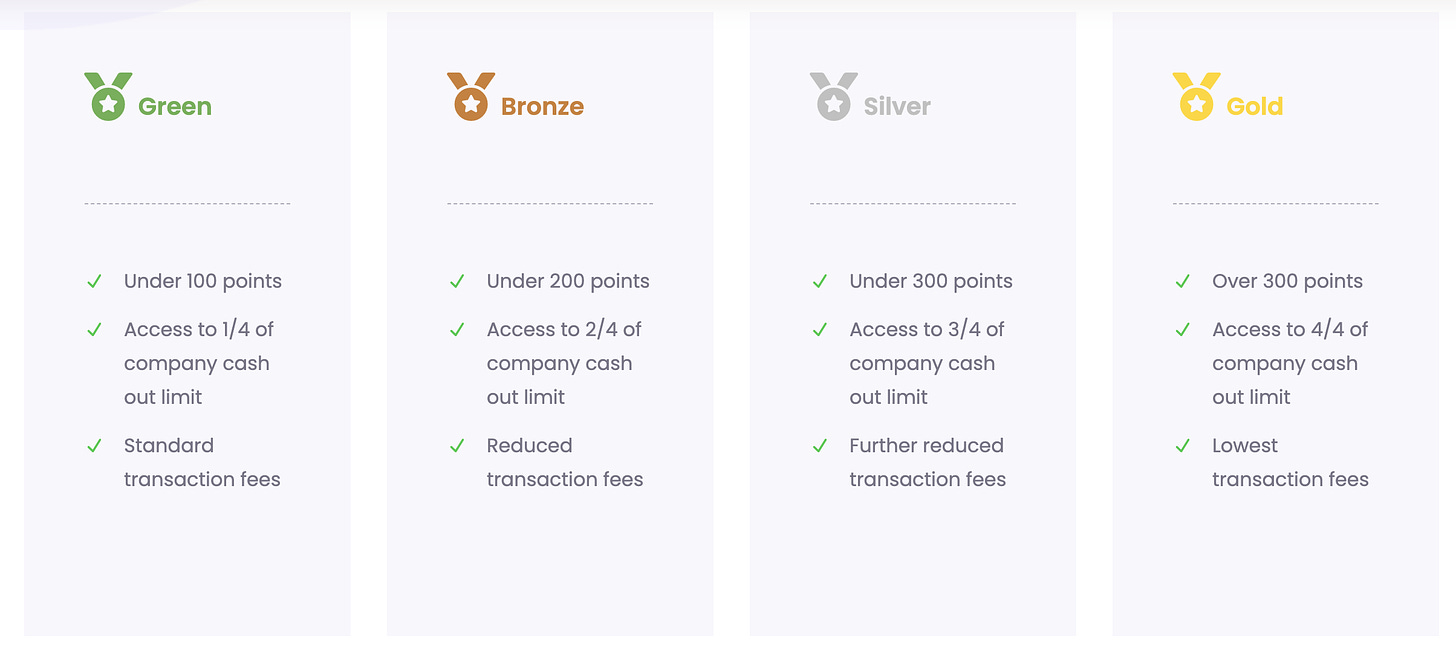

Paymenow:

Employers sign up & onboard their employees’ information via an admin portal

To request an advance an employee needs to download the app

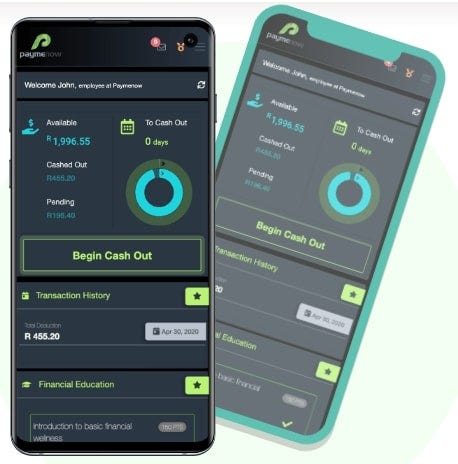

Paymenow gives the employee an interest-free advance on their income earned based on a points system.

Employers can reconcile payroll via the admin dashboard.

Like SmartWage Paymennow does not charge interest on the cash advance nor do they charge the employer fees for the service. The main revenue driver here is also transaction revenue. The transaction fees are not stated on the website though.

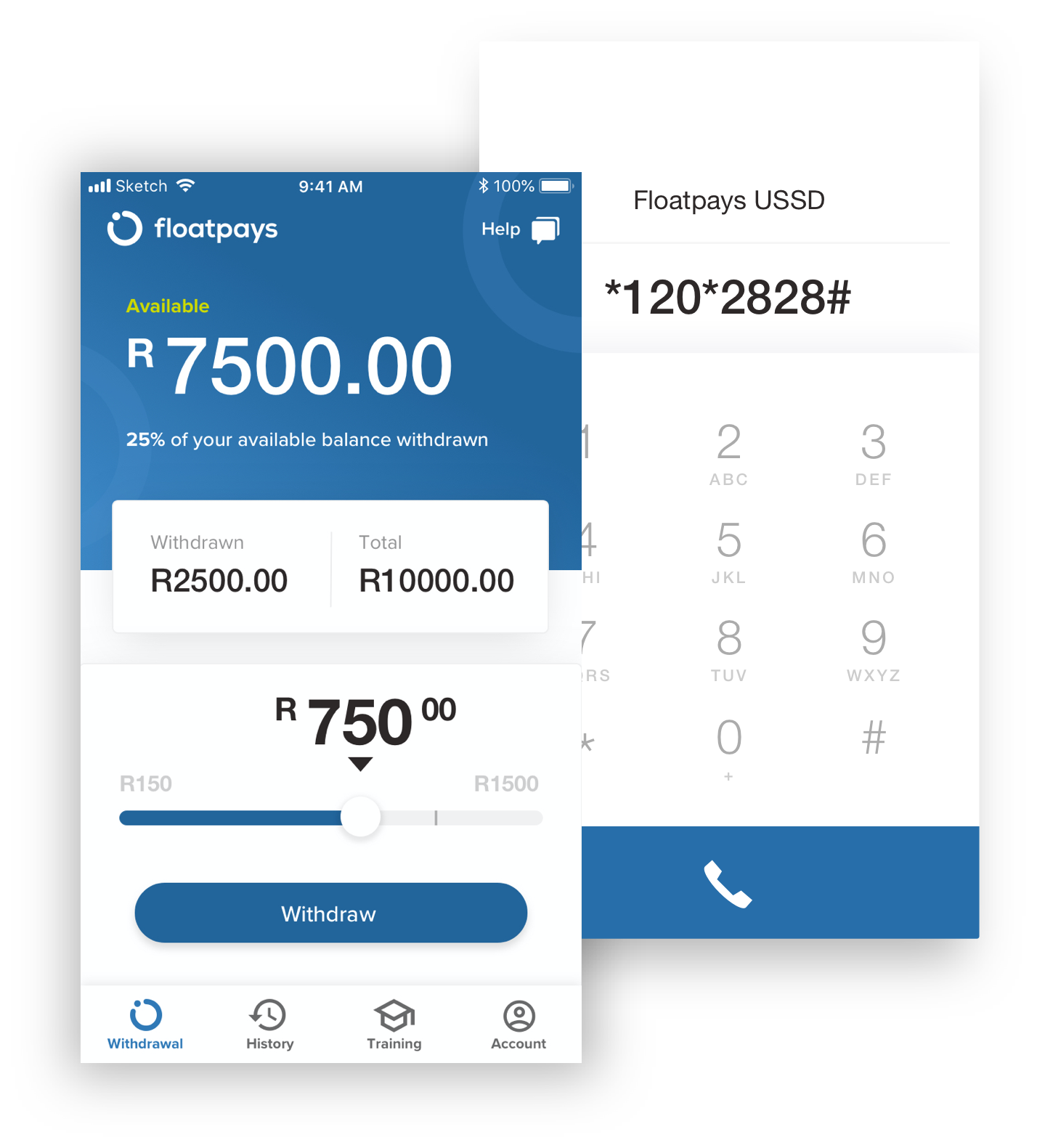

Floatpays:

‘Can integrate directly with a company’s payroll system & the employer sets the rules of withdrawal for employees.

An employer can integrate Floatpays with their payroll at no cost to them

The employer can then invite employees to the system via a USSD push notification

The employee can choose to accept or decline — if they do accept they can then download the app & input their details to withdraw the advance.

Parameters of how much they can withdraw are stipulated by the employer

Floatpays makes money through transaction fees upon withdrawal.

I suppose the target market is small & medium businesses with less than 250 employees. Just focusing on the strategy & business model here these reimagined payday lenders are going for volume & distribution by targeting businesses rather than individual employees.

I get the premise of the idea, unregulated micro-lending is crippling consumers with overstretched budgets. By allowing them to access what they have already earned in case of an emergency. But then again the most prudent way to empower positive financial behaviour is through the encouragement of positive savings behaviour. Not to sound as if I live in a bubble, regardless of the fact that on average South Africans are paid above minimum wage, 1 in 3 South Africans are paid below the minimum wage. I might be contradicting myself here given my statement in the beginning about fair compensation. A lot of people have had to take pay cuts due to COVID so positive savings behaviour is a bit difficult when people already live hand to mouth.

I don’t have a conclusion here, I hope to formulate a discussion around this. It is an interesting trend & hopefully, we can have a dialogue.

Take care.

The largest employer here is the state and the gains they make will be incremental until they incentives are aligned to compete with the incumbents. Everything in this area is done by trade unions, where its tit for tat. Banks will probably htake the lions share of this marketwhen they enter it as seen with stripe. In conclusion they are the first but not the last.

I enjoyed the read as I wasn’t even aware of such systems. I think certain organizations can implement these systems in SA. A relatively large part of our population aren’t too tech efficient in basic use. So that may be a barrier for other. Also there’s still stigmas or cautions around using online banking for others. Some may believe that a family member for example could access these funds without their knowledge while using their digital device .

But I’m in agreement the positive savings part