South Africa 5 years from now

A look through the lens of E-commerce & FinTech in Brazil from 2015-2020.

Issue #34: Hello there, Welcome back. If you are new, welcome to you too!. It's been a while. 4 months ago I joined an amazing team over at TFG Labs (were hiring!) to work on the future of commerce in Africa, so I have needed some adjusting & learning. On Monday mornings I used to (lol) share a newsletter about tech-enabled startups in South Africa, or how certain technology trends might be relevant for South Africa & sometimes the founding story of innovative companies. This week I want to tackle a market-related topic, specifically how South Africa today looks similar to Brazil in 2015 & how that could influence the future of E-commerce, FinTech & Venture investing.

Over the past two years, I’ve bumped into the Brazilian tech market on various occasions, mostly researching verticals like FinTech or recently retail & e-commerce. But I have never dived deeper than macroeconomic factors that influence those markets. When I started reading at the tip of how Brazil has become the largest Latam market for VC investment I found similarities to South Africa. Both countries have had a tumultuous decade which started out on a high then their economies deteriorated due to falling commodity prices, political instability, rising unemployment with service delivery protects & presidents tainted by corruption scandals. Both countries saw their tech ecosystems emerge with the rest of the world, Brazil a magnitude higher than South Africa.

Brazil 🇧🇷 September 2015

Brazil’s economy was deteriorating from the highs of the early 2010s. 3 quarters into the year GDP sat at -3.2%. President Dilma Rousseff had been fighting impeachment over a corruption scandal. Investment into the country was declining, consumption by households was decreasing, unemployment rose from 4.7% to 7.9% in 12 months. The Brazilian Real was depreciating against the dollar as fuel prices increased. The government deficit sat at 10%, Interest rate payments crept up to 8.9% of GDP while debt-to-GDP ballooned to 67%.

September was a culmination of 12-months of havoc in Brazil & ended with Standard & Poor downgrading Brazil’s bonds to junk status. By March 2016 all rating agencies had downgraded Brazil to junk status.

Brazil’s downturn was a result of bad fiscal policies, corruption scandals & an inability to move the needle on the working class. The world was looking in despair as The Brazil Model faltered. But across the ocean, a country at the tip of Africa, a fellow BRICS member was having troubles of its own with a deteriorating government, languishing in corruption scandals as unemployment increased. Their stories are too similar, almost identical in nature.

Nothing much has changed, each country voted in new presidents that lean more to the right (Cyril is centre-left, a bit right to Zuma’s left, to borrow American terminology). The period of turmoil has sustained somewhat in both nations, growth being subdued, lower than the world average. But technology growth, innovation & funding that serve small businesses & consumers have rapidly increased in Brazil.

Macro comparison: 🇧🇷 vs 🇿🇦

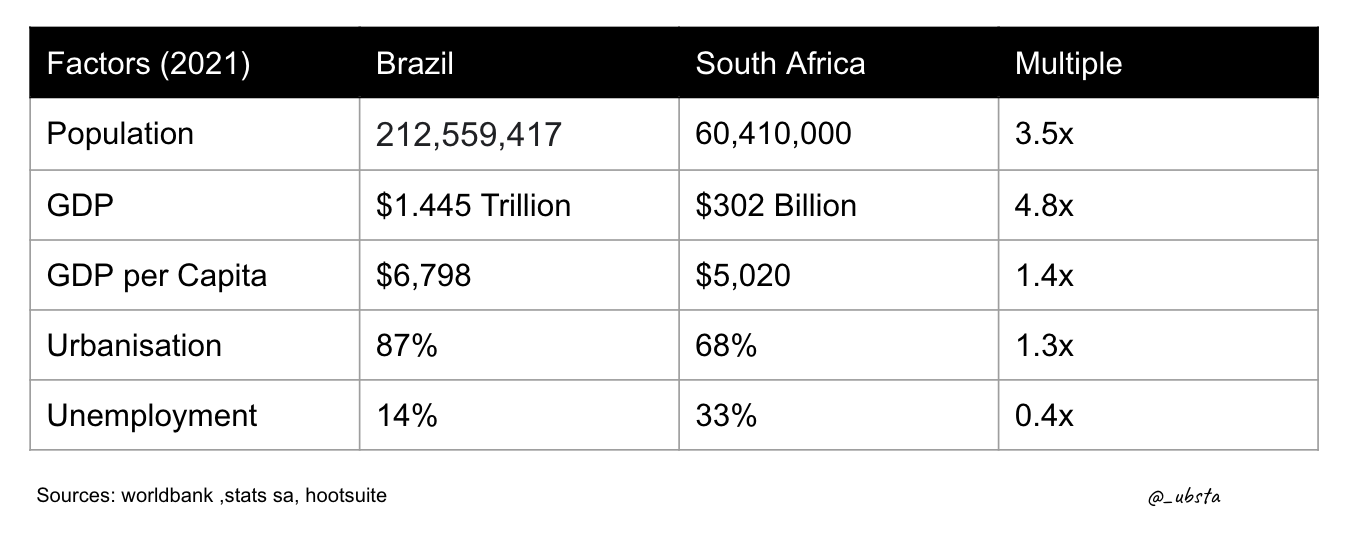

Brazil’s population is 3.5x that of South Africa with a 4.8x higher GDP. But those are absolute numbers, GDP per capita is only 1.4x that of South Africa. The numbers add up for Brazil as a single investment market due to the population size but South Africa does punch above its weight, though, disproportionally driven by inequality. Brazil has a higher urbanisation rate than South Africa with a far lower unemployment rate (increased due to COVID).

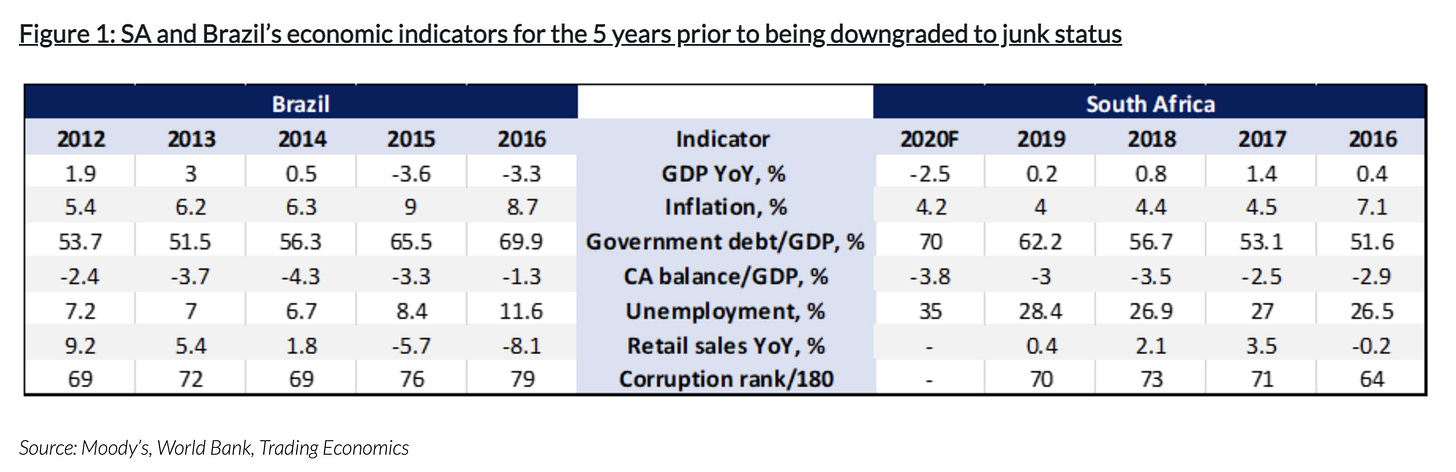

The retrospective comparison of why South Africa is where Brazil was in 2015, leading up to 2016. Brazil’s economy declined significantly during those periods with inflation rocketing with debt-to-GDP. The country faced a Current Account (CA) deficit with unemployment increasing as retail sales decreased. If you thought South Africa was corrupt, look at Brazil’s corruption ranking out of 180 countries.

Given the similarity of both countries’ respective journeys to junk status, it may serve SA well to take a more critical look, not only at Brazil’s economic policies pre-downgrade, but also at its attempt at structural reform thereafter. There may be a valuable lesson to be learned for SA as we take our first tender steps forward through junk status territory. - Anchor Capital

Post junk status Brazil’s economy has continued to deteriorate, debt-to-GDP increased to 91.6%, GDP was 1.4% in 2019 before COVID, still lower than the high of 2012. GDP per Capita is languishing at its lowest levels since 2007. Then why is tech investment drastically increasing? the answer; future potential.

Retail sales have increased dramatically in Brazil on a month-to-month basis, even pre-Covid.

Consumers in Brazil were spending more, not because of growth, but despite it. Unemployment has been climbing since 2015.

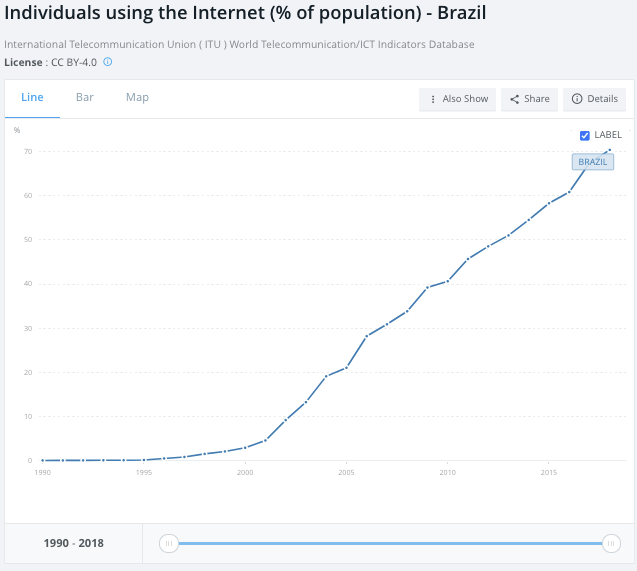

Why was this happening? What was driving this? … Years of investment in enabling entrepreneurship. The successes of Mercado Libre, the growth of Pagseguro & Stone introducing financial services for small businesses. The growing power of e-commerce services like D2W & the new startups created to tackle fragmented markets. All of this has been enabled by the growing consumer base of internet users driven by a lower cost of access (cost per 1mb of data in Brazil is currently $0.92 (~R13)).

The Enablers – Hotmart & Olist

Around this time (2015) funding had been at a decline in Brazil for the last 2 years. But a new brand of startups were raising & growing very fast. These were predominately in the FinTech & E-commerce sector. This growth attracted more dollars for the Brazilian ecosystem for years to come.

But the innovations that have the greatest & the most sustained impact on economic output are those that enable others to create more value for themselves. In simple terms innovations that become platforms, marketplaces with innate network effects create an outsized impact on economic value. This happens when value accruals disproportionately to those who build on top (think AWS, Shopify).

Part of Brazil’s growth in technology has been driven by these enablers building platforms that increase the economic value add of participants. Let’s start with the platforms that help more people start & grow their online businesses. According to datamark, entrepreneurship in Brazil has hit the highest level in 20 years. 1 in 4 adults are starting up new businesses. This endeavour is driven by favourable economic policies & businesses that are making it easier to do so. The first one is Hotmart.

Hotmart is a platform that allows creators to build & sell digital products. They describe themselves as “The All-in-One Solution for Creators to Become Entrepreneurs”. Founded in 2011 by João Pedro Resende & Mateus Bicalho who set out to build a platform that helps creators monetize their audiences by building & selling digital products, Hotmart unlocked what is now globally called the creator economy. Today, Hotmart has 37 million users selling 470 000 products in 188 countries.

It’s logical to assume that South Africa & its creators would benefit from a platform like Hotmart. As more young South Africans look to content creation as a career field. Enablement & monetization become key. Will we have a Hotmart in South Africa? fast forward 5 years I certainly hope so.

The second company enabling businesses to grow is Olist. Founded in 2015 by Tiago Dalvi, Olist is an e-commerce marketplace integrator that connects traditional offline small businesses & new entrepreneurs to marketplace businesses like Mecardo Libre, D2W, Via Varejo & Amazon. They use what’s called a shop-in-shop model (a shop inside a shop), where small businesses are aggregated on Olist Store & promoted inside the various marketplaces. This helps the business manage the fragmentation between the various platforms. Instead of cross-listing items & managing the inventory in conjunction with their existing physical store, a business can list items on Olist Store & have them syndicated across all marketplaces. For a closer to home example, instead of small businesses listing items across Takealot, Loot, Makro etc they can list them on one platform that manages their inventory & logistics across all of them.

Through this shop-in-shop model, Olist has managed to sign up 7 000 retail businesses for Olist store with over 7 million products sold. Like payment companies around the world, during the early COVID period, Olist built a new online shops feature called Olist Shops, a quick way to create an online store that has signed up over 200 000 online merchants. Recently, Olist acquired click space & a logistics service called Pax to expand their offering for small retailers. Olist Store saw a 68% increase in sales in 2020.

Now the question is why would small businesses list on Olist when they can go directly to the marketplaces? they provide an explanation:

“The difference lies in optimizing your routine as a retailer. In the olist store , through a single registration, you have access to all marketplaces at once. This means that when you register your product on our platform, we take care of publishing it on Mercado Livre, Americanas, Amazon & other channels. You don't need to go site by site, create an account & upload product by product.

In addition, managing sales with the olist store is also much simpler, as all orders are centralized on our platform, without the need to access other pages.

In short: the difference between registering in the olist store & in other marketplaces is practicality . Here is an account, a register, all channels & centralized management; in the marketplaces there are multiple accounts, multiple registrations & more time dedicated to sales management.”

I’m sure most merchants choose to cross-list directly with marketplaces in addition to Olist, but what Olist is doing is brick n Mortar enablement, allowing businesses with a physical store presence to sell online via multiple channels without the admin headache. Olist states that businesses see a 4x increase in sales because of them.

This practicality seems to be the solution that enabled Olist to grow into a $1 billion+ business. As e-commerce continues to grow in South Africa with marketplaces designed for 3-party sellers like Takealot Marketplace, Loot, Jumia, Zando, Makro, even Facebook Marketplace. The opportunity of enablement through marketplaces will present itself. Takealot’s GMV was R16.7 billion ($1.022 billion) in 2020 thanks in part to third-party marketplace sales growing faster than first-party sales.

The point I’m trying to make here is that enablement of entrepreneurship creates value for the whole economy, especially future proof solutions that allow small business owners to exist both online & offline. Over the last 5 years, during times of turmoil, Brazil has seen unprecedented growth in entrepreneurship for the country, 2015 being the tipping point of economic turmoil. The theme is perseverance & innovation in the face of uncertainty.

Enablement by itself is not the only catalyst, financial service unlock for consumers is another one.

The Financial Providers - Creditas & NuBank

FinTech in Brazil needs no introduction, by far the largest recipient of venture funding over the past few years. The 2 biggest newer players with an outsized impact on consumers have been Creditas & Nubank.

Originally called BankFacil, Creditas is a $1.75 billion FinTech founded in 2012 by Sergio Furio an ex BCG consultant from Spain. What Creditas is, is a financial ecosystem that provides low-cost, digital home & vehicle financial products to consumers. It started as a guaranteed credit marketplace that allows banks to offer secured loans to consumers. This has expanded to other products for home, vehicles, salaries & gadgets.

Brazil, looks very much like South Africa from a banking environment. 5 banks control 80% of the market. Very high personal debt with high-interest rates for consumers.

What Sergio found was that home & vehicle ownership in Brazil was higher relative to the average. Homeownership amongst working adults sat at 73% with 8 out of 10 households owning a vehicle. The unique thing about Brazil was that the mortgage market was not fluid. Most homeowners had no-to-low debt on their homes but very high personal debt. With this knowledge, Sergio evolved the credit marketplace to offer refinance products backed by home equity as a way to help individuals in Brazil decrease their personal debt.

In 2018, Creditas issued its first mortgage-backed security & began originating loans in 2019.

The simple impetus of Creditas is helping individuals pay down their expensive personal loans by unlocking their home equity.

“Creditas is all about providing liquidity to the owners of illiquid assets. If you think about it, people work most of their lives to create wealth that is trapped in real estate property or their cars. In Brazil alone, there is a USD 3 trillion pool of assets in the combination of consumer real estate & cars. Today, consumers are only using a fraction of those assets to secure low-cost debt (currently only ~7% of that total value is used as loan collateral). If we can use those assets & inject that liquidity back to the consumer, if we can tap into this opportunity, in a seamless way, the impact would be massive. We could triple the available funds in Brazil, & that would mean better education, more small business investments, home renovations… & we could do all this at a fraction of the cost that they are currently paying to their friendly neighborhood bank”. - Sergio Furio, Vef VC interview

Creditas has expanded its offering to provide car financing & refinancing, property remodelling, payroll loan & a buy now pay later e-commerce store.

Creditas has created a market for itself & its customers in Brazil, allowing them to gain liquidity in a secure environment. For that, Creditas earned itself a low default rate.

Banks aren’t naive to innovation when the product is money, the big banks still originate 75% of consumer loans in Brazil, albeit with a lower share than they used.

This is due to the entrance of Nubank into the market. Founded by David Vélez in 2013, Nubank is the biggest challenger bank in the world by customer size & revenue. 40 million customers with $528 million in revenue. Nubank has been the poster child for rising digital banking, together with the trio of Revolut, Monzo & N26.

But what is their impact on consumers in Brazil? The market of Brazil is no stranger to financial services, a heavily card-based nation truly dissatisfied with the current offering in the market due to the high cost of banking (similar to South Africa). That was the market opportunity for Nubank. The problem was not financial inclusion, though, 45 million adults in Brazil lacked access to financial services. The problem David Vélez & his team were trying to solve was not non-consumption, rather simplicity & affordability. Not dissimilar to what Capitec has done over the years.

Business model innovation was the key unlock. They solved for access & time, cutting out the need to visit a branch to obtain a credit card. They built a new credit infrastructure for the people of Brazil that did not preclude them due to legacy policies & most importantly, removed cumbersome fees that inhibited adoption & the need for Brazilians to have multiple accounts with multiple banks. They became an entry point for new customers & provided additional services to customers & business owners.

The Nubank story is one of the most pivotal drivers of investment in Brazil. Their success is the success of the ecosystem & a driving factor for the rise of innovation in Brazil over the last 5 years.

This story is not dissimilar to that of Capitec, but Capitec is a 20-year-old listed company. A case study of innovation through simplicity. They weathered the storm of COVID when most felt they would fumble due to their customer base. Capitec’s customer resilience serves as a testament to the endurance of South Africans the same way that Nubank’s success is for Brazilians. But the story of FinTech in Brazil is also the story of Pagseguro & Stone.

The Merchant Guns – Pagseguro & Stone

The similarities of Pagseguro & Stone to South Africa’s current state of mobile payment systems for small businesses is uncanny.

Let’s start with Pagseguro. Born out of Universo Online, the Yahoo of Brazil, Pagseguro is a financial services company focused on merchants (& now consumers). It began as a payment gateway in 2006 & later a mobile payments system with the rise of Square clones. The story arc is quite similar to that of Yoco where the market they entered was fragmented & not suited for individual small businesses. The existing incumbents rented out Point of Sale terminals (POS) & had stringent fees which inhibited the adoption of POS terminals in a country with high banking penetration.

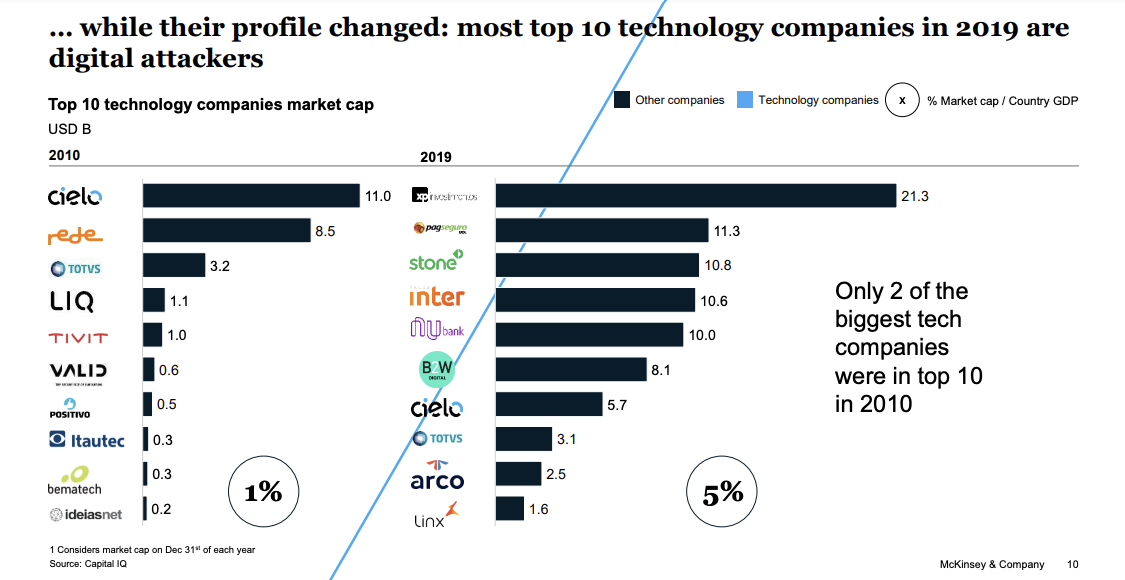

In a market still dominated by large incumbents like Cielo & Rede, Pagseguro’s merchant business has continued to grow with over 7 million merchants on the platform & the launch of Pagbank. The ambition is limitlessly enabled by the growing base of small businesses & high consumer adoption of digital services with the ultimate goal of becoming a super-app for financial services. As Brazil moves closer to looking like China, & the comparison to South Africa, fast forward 5-years it is quite plausible that South Africa will look like Brazil today – at least from a technology perspective.

Like Yoco in South Africa with iKhokha & the whole Adumo network, Pagseguro has a challenger in the MPos space. That challenger is Stone Pagamentos. launched in 2012 by André Street & Eduardo Pontes who had been working in payments since 2000 with a company called Braspeg. Unlike Pagseguro, Stone’s focus has been on medium-sized businesses with a suite of services that covers 650 000 SMEs in 1 500 cities.

Why are these companies growing in a declining economy where 50% of transactions are cash? It’s the opportunity presented by a heavily banked population & the growing innovations enabled by dollars flowing into the market. & consumers in urban areas demanding it.

South Africa is where Brazil was 5 years ago. Both Pagseguro & Stone are now public companies & two of the biggest technology companies in Brazil with market capitalizations of $18.24bn & $18.25bn respectively.

Conclusion

In conclusion, there are more similarities in Brazil & South Africa’s tech ecosystem than there are dissimilarities. I believe that it is still early days, with South Africa at the same point as Brazil in 2015. Digital services will grow despite the circumstances of the country driven by these two sectors that are tied to the hip. We are seeing large rounds of funding being announced by FinTechs with digital commerce adoption skyrocketing. But there are other sectors like logistics, healthcare, real estate etc that will benefit too. Again, the success of tech in Brazil is because of the successes of Mercado Libre, the growth of Pagseguro & Stone. The growing power of e-commerce services like D2W & the new startups created to tackle fragmented markets. All of this has been enabled by the growing consumer base of internet users driven by a lower cost of access.

Take care.

Oh, I didn’t touch much on the other companies in logistics (loggi) or real estate (loft) but these are also success stories of tackling fragmented markets. Like South Africa, incumbents are strong in Brazil, but with time that will change if they fail to adapt to the radically shifting landscape.

I also think that the monetizing models that these platforms come with can be looked at, for example: Stripe payment method (exclusive based on location) vs Paypal (that is inclusive globally), these things have a direct impact that enables economic inclusion globally for passionate humans wanting to grow digitally.

Excellent synopses and great comparative analyses. With Bettr, we've just done a similar study; very much aligned to the hypothesis, now it's all about execution for this booming very near future.