Banking on Zero or Banking on Bettr?

The Hub & Spoke Model; The Prudential Authority & Twin Peaks; BankZero & Bettr; Closing

Hello there, Welcome back. If you are new, each week I write about tech-enabled startups in South Africa, or how certain technology trends might be relevant for South Africa & sometimes the founding story of innovative companies. This week I want us to tackle banking in South Africa from the lens of the new challengers, Bank Zero & Bettr.app, focusing on their replication of the Hub & Spoke model for banking.

This is not a comparison of the two new digital banks. They are different; in makeup & target market. What they have in common is the model they have chosen to build about a digital bank; the Hub & Spoke model.

Over the last 7 years, a global challenger & neo banking revolution happened — well sort of — the world was told that 'banking is broken'. That we no longer need branches because everyone has a smartphone. All our needs can & will be taken care of through this smart computer in our pockets. The other thing the world was told was that banking like insurance has a conflict of interest. The business model is not aligned with the people it serves. In this case, banks & depositors have misaligned incentives. So new banks were created; challenger banks & neo banks.

What are they? challenger & neo banks?

What is the difference between a challenger bank & a neo bank?

For simplification, we can use this definition:

"Neo banks do not have a banking license but rely on a partner bank to operate. A Challenger bank has a full banking license to operate”- Amanda James

Removing all things said about regulation. They are digital-first banks that live on your phone through an app.

There are hundreds of challenger & neo banks in the world targeting millennials & Gen Z. With a few like gohenry & Greenlight purely focused on teenagers. As you can tell I have no idea where the generational cut off age is but that's fine, what I am trying to get across is that global incumbent banks have faced pressure from all directions for existing clientele as well as future customers.

In South Africa, 5 banks were granted a banking license to operate in the last 6 years (African Bank, Postbank*, Discovery bank, Tymebank & Bank Zero). Bettr, as a neo bank leveraged the license of an existing retail bank to act as an over the top bank. The Prudential Authority is the custodian of all banking licenses as mandated by the South African Reserve Bank. South Africa adopted what is called a ‘Twin Peaks’ model for regulation in 2017. We will get into what that entails. First, I want us to get through how some of the new challenger banks adopted one business model that they deem best to align the incentives of the bank with customers. The same model Bank Zero & Bettr intend to use.

The Hub & Spoke Model

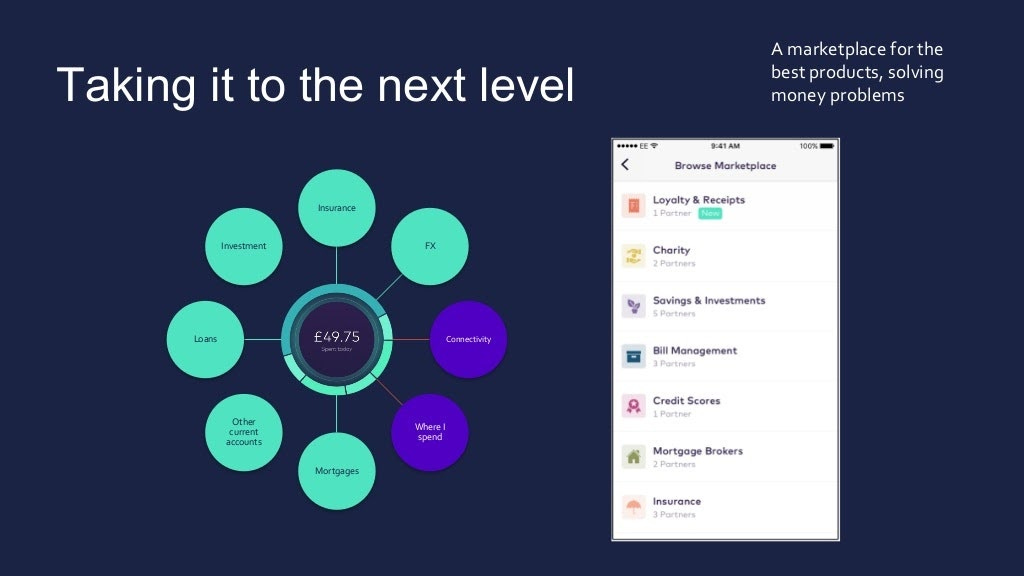

When the London based banks came about in 2015 (Monzo & Starling) the plan was to allow customers to have a central location for money management. The idea that banking is what you do, not where you go. Taking the principles of personal financial management & building a bank around them. Where overview & communication of one’s finances happen from a central hub & disbursement of funds go to best-in-class providers. They believed that if the customer can receive the best available offer for them, that model will be in the best interest of the customer & the bank in the long term. For example, the bank, in this case, Monzo has an overview of a customer’s funds & instead of providing them with a whole suite of products, Monzo picks the best-in-class from different providers to serve the needs of the customers. A mortgage from Habito, a pension fund from PensionBee & an investment fund from Investec UK etc.

Tom Blomfield, the founder & former CEO of Monzo believed in the idea that the bank of the future will be a marketplace ie Hub & Spoke. Now in theory that sounds understandable, why shouldn’t the customer get the best possible deal every time?

In theory, the model will work for customers & partners. PSD2 & Open banking allows for freedom of information to flow through APIs & thus the age of hub & spoke banking. The critique brought forward was — how does the model work for Monzo & Starling?

Like any marketplace, the business model is a fee for connecting buyers & sellers. Because the products are curated to best-in-class, the customers in the long term will place their trust on the bank & the bank is incentivized to give the customer the best possible products, thus alignment incentives. This is on top of the interchange fee (a fee the bank receives when a customer pays with a card at a merchant) & on balance sheet lending (personal loans & credit cards).

Regulators around the world have been receptive to this model (so have investors) but sceptics point to the financial statements of both Monzo & Starling. Which are far from stellar & thus deem this model a failed exercise. It doesn’t help that these challengers banks are digging around for more revenue with premium plans that have more software benefits as opposed to fixing on balance sheet lending.

But it is still early days, it’s only been 5 years. New models should be given time to manifest with the help of all ecosystem parties.

In South Africa, Bank Zero & Bettr have chosen this model as the future of banking, with the support of the regulator; The Prudential Authority.

The Prudential Authority & Twin Peaks

As stated above the Prudential Authority is the custodian of all banking licenses as mandated by the South African Reserve Bank. Given the enactment of the Financial Sector Regulation Act 9 of 2017 on the 22nd of August 2017. The Prudential Authority (PA), together with the Financial Sector Conduct Authority (FSCA) were established on the 1st of April 2018. The objectives of the PA were:

promote and enhance the safety and soundness of financial institutions that provide financial products and securities services;

promote and enhance the safety and soundness of market infrastructures (MIs);

protect financial customers against the risk of these financial institutions failing to meet their obligations; and

assist in maintaining financial stability.

FSCA’s objectives were:

promoting the fair treatment of financial customers by financial institutions;

providing financial customers and potential financial customers with financial education programs; and

promoting financial literacy.

Together the PA & the FSCA make up the Twin Peaks. Before the separation, the Financial Services Board (FSB) preceded the FSCA & was the custodian of non-banking financial institutions & the Financial Intelligence Centre (FIC). The Financial Services board act was enacted in 1990 together with the Banks Act (The Banks Act,1990). The Bank Act took care of banking regulation & the FSB act took care of non-banking financial services regulation. The introduction of the Financial Services Regulation Act of 2017 & the twin peaks created clarity around two things: 1. regulation of all financial services & 2. consumer protection. The Act was deemed highly progressive for the future of South Africa’s financial services sector.

The PA consists of 4 departments:

Banking, Insurance and Financial Market Infrastructure (FMI) Supervision

Financial Conglomerate Supervision

Policy, Statistics and Industry Support

Risk Support.

All four departments report to the CEO of the PA.

Under the supervision of the Reserve bank, the PA has a three-year plan on regulatory & supervisory priorities & for the sake of our reading we will focus on one particularly important one; section 5: The PA’s approach to transformation, financial inclusion and competition.

Which states:

“The role of financial institutions, both domestically and internationally, is being disrupted, at a rapid pace, by innovative and emerging technologies. The PA recognises the potential of such developments to improve access and efficiencies in the financial sector. The SARB recently established an internal Fintech programme to focus on three key areas, namely (i) to consider policy and regulatory implications of specific fintech innovations; (ii) to collect data on the local fintech industry; and (iii) to assess the appropriateness of innovation facilitators, including a regulatory sandbox. As part of its mandate to support financial inclusion, the PA will collaborate with the SARB in monitoring fintech developments that may potentially facilitate financial inclusion through affordable and appropriate financial services and the entrance of smaller players into the market”.

The PA further created a new approach to supervision:

“The PA’s approach to supervision is risk-based and proportional, forward-looking (pre-emptive), outcomes-focused and integrated. The supervisory approach will be embedded through supervisory tools. There are four phases in the life cycle of a financial institution where prudential supervision is exercised.

These phases are:

1. licensing

2. supervision

3. enforcement

4. resolution (in collaboration with the SARB).

The focus is mainly on the supervision phase and it accounts for most of the PA’s supervisory activities”.

Because the focus is on supervision, getting a license is not an easy process. Both BankZero & Bettr went through an 18-month application process for licensing. Even though the former is a Mutual Bank & the latter going with an already licensed partner bank.

Progressive, but stringent regulation. Important in the age of FinTechs.

BankZero & Bettr

Both digital banks have had a long road to launch. But they come with a unique value proposition to an already crowded market. In the last 2 years, retail banks like Discovery Bank & Tymebank have disrupted the market, particularly the latter, offering low fees & ease of use with a simple android app. Tymebank built a proprietary distribution model with its kiosk in Pick n Pay retail stores. Discovery bank has grown its deposit & lending book with its value proposition of dynamic interest rates. & yet people eagerly await the launch of BankZero & Bettr. Bettr with the focus on Gen Z launched a media campaign with a music video that has helped grow the waiting list.

The Bank Zero team announced the bank's intended arrival back in January 2018 having spent 9 months lobbying the regulator for a Mutual Savings Bank license.

A mutual bank differs from a traditional retail bank. In a mutual bank, depositors who place their money with the bank subscribe to a common fund & become shareholders with voting rights. Whereas a retail bank is owned by shareholders, a mutual bank is owned by its depositors. Plus a mutual savings bank license has a lower capital requirement than a retail banking license.

Bank Zero was founded by former FNB executives Michael Jordaan (Chairman), Yatin Nasai (CEO), Line Wild (CFO) & Lezanne Human (Executive Director). The thesis for Bank Zero was (still is) — nurturing a savings culture through new technologies, transparency & security. As in the name Bank Zero has zero banking fees but does pass on all third party incurred fees to the customer.

Like Monzo & Starling, Bank Zero’s immediate focus is providing a better banking experience around the cheque account (check account, as they call it) & partnering with other service providers in the medium to long term to provide other banking-related services. The Hub & Spoke Model. Unlike the UK, South Africa does not have a rich consumer fintech market. This might be why Bank Zero is shifting its focus to solo entrepreneurs & small business owners, where partners like Xero exist. The BankZero team is filled with experienced, seasoned executives & I’m banking on them to pull through with the model even if the spokes are made of individual products from different banking providers. I’m sure incentives would be aligned.

Bettr, founded in 2016 by Tobie van Zyl (CEO) & Andrzej Stempowski (CTO). Bettr is a neo bank focused on Gen Z. Tobie’s vision for Bettr is to change the culture of money for the next generation. Bettr has worked with a partner bank for go-to-market & has had to go through the Prudential Authority’s rigorous licensing process to be approved into core 1 & core 2 of the national payments system for clearing & settlement.

Bettr has had a long road to launch, redefining the value proposition & changing technology partners. A true testament to the rigour of financial services regulation in South Africa.

The value proposition — Hub & Spoke. Bettr has chosen to work with other Fintechs in the market to provide services outside the savings account. Like Monzo & Starling, the business model is interchange (Bettr shares interchange with their partner bank) plus marketplace revenue share.

Closing

In South Africa's banking environment, Capitec is now the elephant in the room. With over 13 million customers & breaking barriers of what a traditional banking client is & how to serve them. The fundamental questions remain; how is banking broken? & is the Hub & Spoke model the right approach to building a bank?

Starting with the latter my answer would be, I don’t know I’ve never built a bank, plus like I said it’s still too early to judge. But as consumer & an avid FinTech fan (bordering obsession) I would say it depends. Everything depends on execution, picking best-in-class spokes, focusing on user experience, a different & unique UI etc. Those are the thing I would want, as a customer.

On the former, is banking broken? well, the answer to that is when has it ever been great? what would be a good comparison be? For all my adult life I have had to pay bank fees, that’s all I’ve known. It is only now that we are told bank fees are ridiculous & customers should not be paying them. Misalignment of incentives? probably. In South Africa, the colour of your card is supposed to be a status symbol & a measure of income. Another thing killed by Capitec. Other things don’t make sense to me like how mortgage rates work? balloon payments on cars, why? because the bank says so?

Maybe banking is broken but unlike the UK, South Africa’s consumer fintech market is not robust enough for a marketplace model. But if we, as consumers could cherry-pick the best possible products from whatever bank, now that would be a compelling value proposition.

Take Care.

*The Postbank is in the process of being granted a full banking license as we speak. Given its a state owned bank it will almost certainly be granted.

Thank you for the article. I have been underestimating our fintech space you’ve opened up my mind 😁😄

Thanks for the write -up Ubulele. Feel free to get in touch for more info. Drop us a line at info@bettr.app. Tobie ;-)